Results show strong demand at Heathrow as travel restrictions ease

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 28 October 2021 | International Airport Review | No comments yet

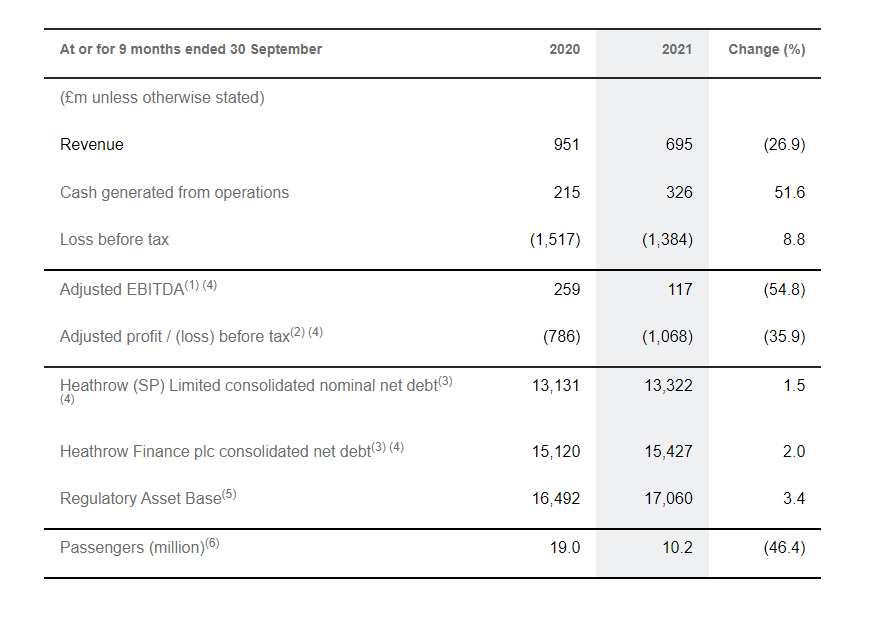

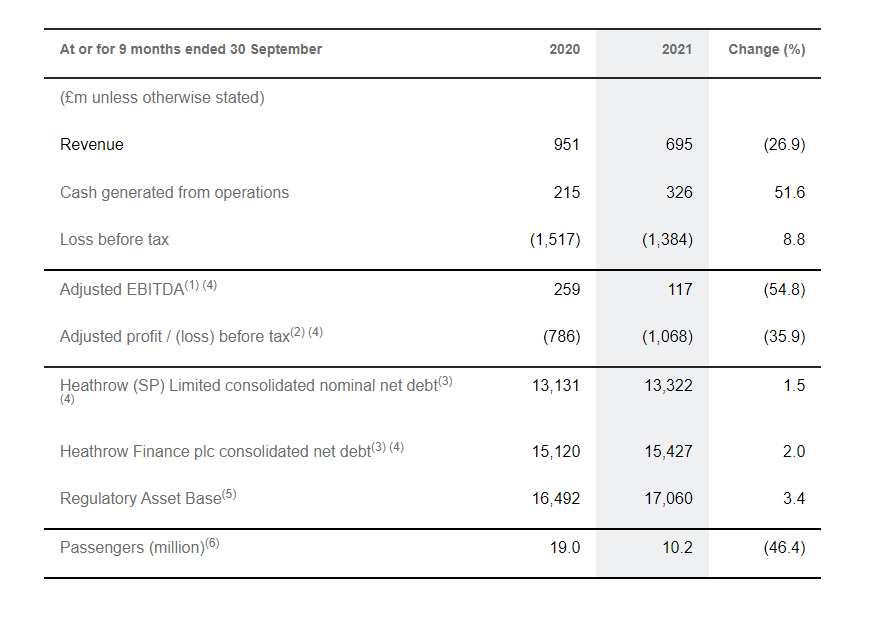

Results from the past nine months at London Heathrow reveal a strong demand since travel restrictions have eased, as well as a slow recovery in passenger numbers, finances, and airport sustainability.

Credit: London Heathrow Airport (LHR)

Strong pent-up demand as travel restrictions ease – In Q3, Heathrow experienced its first full quarter of passenger growth since 2019, underscoring strong pent-up demand as travel restrictions eased and testing requirements were simplified. Passenger numbers in Q3 recovered to 28 per cent, and cargo to 90 per cent of pre-COVID-19 pandemic levels. Traffic is not expected to fully recover until at least 2026.

£3.4 billion in total losses since the start of the COVID-19 pandemic underscore long road ahead – Airports have very high fixed costs and despite over 30 per cent reduction in operating costs, Heathrow has lost £3.4 billion cumulatively since the start of the COVID-19 pandemic and remains loss making today. We have the financial strength, with £4.1 billion of cash, to be able to come through until the market recovers.

Sustainable Aviation Fuel (SAF) mandate will accelerate decarbonisation – The UK government’s ambition to implement a mandate for at least 10 per cent SAF use by 2030 and £300 million kickstart funding for production in the UK, provides leadership by example to other world leaders ahead of the COP26 summit in Glasgow. We now need government to set higher mandate levels for 2050 and provide a price stability mechanism, such as contracts for difference, to scale up supply as fast as possible. Passengers can purchase SAF for their flights through a number of airlines, including British Airways, or from independent platforms such as CHOOOSE, who have partnered with Heathrow.

CAA H7 initial proposals do not go far enough to ensure financeability – We have transformed Heathrow through private investment so that it is now rated by passengers as one of the top ten airports worldwide, and airlines are able to achieve premium margins at Heathrow. However, our shareholders have achieved negative returns in real terms over the last 15 years. The CAA’s Initial Proposals do not go far enough to ensure that investors can achieve a fair return in H7, which is key to securing future private investment in passenger service and resilience for Britain’s hub airport.

John Holland-Kaye, Heathrow CEO said: “We are on the cusp of a recovery, which will unleash pent-up demand, create new quality jobs and see Britain’s trade roar back to life – but it risks a hard landing unless secured for the long-haul. To do that, we need continued focus on the global vaccination programme so that borders can reopen without testing; we need a fair financial settlement from the CAA to sustain service and resilience after 15 years of negative real returns for investors; and we need a progressively increasing global mandate for Sustainable Aviation Fuels so that we can protect the benefits of aviation in a world without carbon.”

Credit: London Heathrow Airport (LHR)

Related topics

Air traffic control/management (ATC/ATM), Airport crisis management, Airport development, Airside operations, COVID-19, Emissions, Funding and finance, Passenger experience and seamless travel, Passenger volumes, Sustainability, Sustainable Aviation Fuel (SAF), Sustainable development, Terminal operations