IATA data shows air cargo increased 9.1 per cent in September 2021

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 4 November 2021 | International Airport Review | No comments yet

The International Air Transport Association has released results for global air cargo markets in September 2021, showing an ongoing demand that will exceed pre-COVID-19 levels.

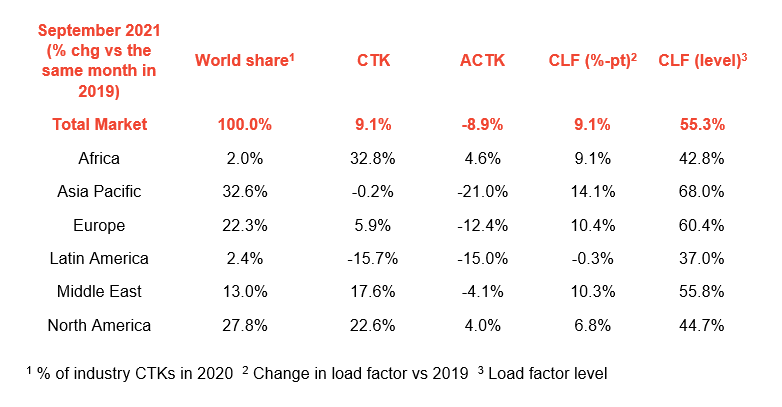

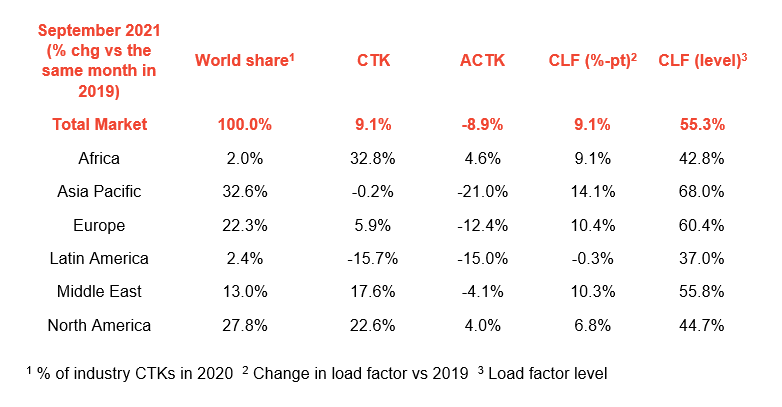

The International Air Transport Association (IATA) released September 2021 data for global air cargo markets showing that demand continued to be well above pre-COVID-19 levels and that capacity constraints persist.

As comparisons between 2021 and 2020 monthly results are distorted by the extraordinary impact of COVID-19, unless otherwise noted, all comparisons below are to September 2019 which followed a normal demand pattern.

- Global demand, measured in cargo tonne-kilometers (CTKs), was up 9.1 per cent compared to September 2019 (9.4 per cent for international operations).

- Capacity remains constrained at 8.9 per cent below pre-COVID-19 levels (September 2019) (-12 per cent for international operations).

Several factors impacting global air cargo demand should be noted:

- Supply chain disruptions and the resulting delivery delays have led to long supplier delivery times. This typically means manufacturers use air transport, which is quicker, to recover time lost during the production process. The September global Supplier Delivery Time Purchasing Managers Index (PMI) was at 36, values below 50 are favorable for air cargo.

- The September new export orders component and manufacturing output component of the PMIs have deteriorated from levels in previous month, but remain in favourable territory. Manufacturing activity continued to expand at a global level but, there was contraction in emerging economies.

- The inventory-to-sales ratio remains low ahead of the peak year-end retail events such as Single’s Day, Black Friday, and Cyber Monday. This is positive for air cargo, however further capacity constraints put this at risk.

- The cost-competitiveness of air cargo relative to that of container shipping remains favorable. Pre-COVID-19, the average price to move air cargo was 12.5 times more expensive than sea shipping. In September 2021 it was only three times more expensive.

Willie Walsh, IATA’s Director General said: “Air cargo demand grew 9.1 per cent in September compared to pre-COVID levels. There is a benefit from supply chain congestion as manufacturers turn to air transport for speed. But severe capacity constraints continue to limit the ability of air cargo to absorb extra demand. If not addressed, bottlenecks in the supply chain will slow the economic recovery from COVID-19. Governments must act to relieve pressure on global supply chains and improve their overall resilience.”

To relieve supply chain disruptions, including those highlighted by the U.S. on supply chain resilience on the sidelines of last weekend’s G20 Summit, IATA is calling on governments to:

- Ensure that air crew operations are not hindered by COVID-19 restrictions designed for air travellers.

- Implement the commitments governments made at the ICAO High Level Conference on COVID-19 to restore international connectivity. This will ramp-up vital cargo capacity with ‘belly’ space.

Provide innovative policy incentives to address labour shortages where they exist.

Credit: IATA

September regional performance

- Asia-Pacific airlines saw their international air cargo volumes increase 4.5 per cent in September 2021 compared to the same month in 2019. This was a slowdown in demand compared to the previous month’s 5.1 per cent expansion. Demand is being affected by slowing manufacturing activity in China. International capacity is significantly constrained in the region, down 18.2 per cent vs. September 2019. Looking forward, the decision by some countries in the region to lift travel restrictions should provide a boost for capacity.

- North American carriers posted a 19.3 per cent increase in international cargo volumes in September 2021 compared to September 2019. New export orders and demand for faster shipping times are underpinning the North American performance. International capacity was down 4.0 per cent compared to September 2019, a slight improvement from the previous month.

- European carriers saw a 5.3 per cent increase in international cargo volumes in September 2021 compared to the same month in 2019. This was on a par with August’s performance (5.6 per cent). Demand was strongest on the large North Atlantic trade lane (up 6.9 per cent vs. September 2019). Performance on other routes was weaker. Manufacturing activity, orders and long supplier delivery times remain favorable to air cargo demand. International capacity was down 13.5 per cent on September 2019.

- Middle Eastern carriers experienced a 17.6 per cent rise in international cargo volumes in September 2021 versus September 2019, an improvement compared to the previous month (14.7 per cent). International capacity was down four per cent compared to September 2019.

- Latin American carriers reported a decline of 17.1 per cent in international cargo volumes in September compared to the 2019 period, which was the weakest performance of all regions. This was also slightly worse than the previous month (a 14.5 per cent fall). Capacity in September was down 20.9 per cent on pre-COVID-19 levels, an improvement from August, which was down 24.2 per cent on the same month in 2019.

- African airlines’ saw international cargo volumes increase by 34.6 per cent in September, the largest increase of all regions for the ninth consecutive month. Seasonally adjusted volumes are now 20 per cent above pre-COVID-19 2019 levels, but have been trending sideways for the past six months. International capacity was 6.9 per cent higher than pre-COVID-19 levels, the only region in positive territory, albeit on small volumes.

Related topics

Air freight and cargo, Airside operations, COVID-19, Economy, Ground handling

Related organisations

International Air Transport Association (IATA), International Civil Aviation Organisation (ICAO)

Related regions

Africa, Asia Pacific and Oceania, Central and South America, Europe, Middle East, North America