IATA reveals latest outlook for airline industry financial performance

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 7 October 2021 | International Airport Review | No comments yet

Despite a cumulative $201 billion loss for the airline industry (2020-2022), the International Air Transport Association has revealed improved results for aviation during the ongoing COVID-19 crisis.

The International Air Transport Association (IATA) has announced its latest outlook for airline industry financial performance, showing improved results amid the continuing COVID-19 crisis:

- Net industry losses are expected to reduce to $11.6 billion in 2022 after a $51.8 billion loss in 2021 (worsened from the $47.7 billion loss estimated in April). Net 2020 loss estimates have been revised to $137.7 billion (from $126.4 billion). Adding these up, total industry losses in 2020-2022 are expected to reach $201 billion.

- Demand (measured in RPKs) is expected to stand at 40 per cent of 2019 levels for 2021, rising to 61 per cent in 2022.

- Total passenger numbers are expected to reach 2.3 billion in 2021. This will grow to 3.4 billion in 2022 which is similar to 2014 levels and significantly below the 4.5 billion travellers of 2019.

- Robust demand for air cargo is expected to continue with 2021 demand at 7.9 per cent above 2019 levels, growing to 13.2 per cent above 2019 levels for 2022.

Willie Walsh, IATA’s Director General said: “The magnitude of the COVID-19 crisis for airlines is enormous. Over the 2020-2022 period total losses could top $200 billion. To survive airlines have dramatically cut costs and adapted their business to whatever opportunities were available. That will see the $137.7 billion loss of 2020 reduce to $52 billion this year and that will further reduce to $12 billion in 2022. We are well past the deepest point of the COVID-19 pandemic. While serious issues remain, the path to recovery is coming into view. Aviation is demonstrating its resilience yet again.”

The air cargo business is performing well, and domestic travel will near pre-crisis levels in 2022. The challenge is international markets which remain severely depressed as government-imposed restrictions continue.

“People have not lost their desire to travel as we see in solid domestic market resilience. But they are being held back from international travel by restrictions, uncertainty and complexity. More governments are seeing vaccinations as a way out of this crisis. We fully agree that vaccinated people should not have their freedom of movement limited in any way. In fact, the freedom to travel is a good incentive for more people to be vaccinated. Governments must work together and do everything in their power to ensure that vaccines are available to anybody who wants them,” added Walsh.

Re-establishing global connectivity, the 11.3 million jobs (pre-COVID-19) in the aviation industry, and the $3.5 trillion of GDP associated with travel and tourism should be priorities for governments.

“Aviation is resilient and resourceful, but the scale of this crisis needs solutions that only governments can provide,” commented Walsh. “Financial support was a lifeline for many airlines during the crisis. Much of that—approximately $110 billion— is in the form of support that needs to be paid back. Combined with commercial borrowing the industry is now highly leveraged. We don’t want handouts, but wage support measures to retain critical skills may be necessary for some airlines until governments enable international travel at scale. And regulatory alleviations—like continued slot wavers while international traffic recovers—will be needed well into 2022.”

Outlook drivers

Demand

Global demand, measured in RPKs, is recovering steadily.

- In 2021 overall demand is expected to reach 40 per cent of pre-COVID-19 crisis (2019) levels. Capacity is expected to increase faster than demand growth, reaching 50 per cent of pre-COVID-19 crisis levels for 2021. The average passenger load factor in 2021 is expected to be just 67.1 per cent, a level not seen since 1994.

- In 2022 overall demand is expected to reach 61 per cent of pre-COVID-19 crisis (2019) levels. Capacity is expected to continue to increase faster than demand, reaching 67 per cent of pre-COVID-19 crisis levels for 2022. Average passenger load factors are expected to recover to 75.1 per cent, a level exceeded in every year since 2005 until this crisis hit, and far below the 82.6 per cent record set in 2019.

Domestic demand, with fewer restrictions in most countries, is driving the recovery. Global GDP is expected to grow by 5.8 per cent in 2021 and a further 4.1 per cent in 2022. Additionally, accumulated consumer savings (worth 10-20 per cent of GDP in some countries) is supporting the alleviation of pent-up demand in unrestricted domestic markets.

- In 2021 domestic demand is expected to reach 73 per cent of pre-COVID-19 crisis (2019) levels.

- In 2022 domestic demand is expected to reach 93 per cent of pre-COVID-19 crisis (2019) levels.

International demand is the slowest to recover owing to continuing restrictions on the freedom of movement across borders, quarantine measures and traveller uncertainty.

- In 2021 international demand is expected to reach 22 per cent of pre-COVID-19 crisis (2019) levels.

- In 2022 international demand is expected to reach 44 per cent of pre-COVID-19 crisis (2019) levels.

Cargo demand (measured in CTK) is strong as companies continue to re-stock. The World Trade Organisation forecasts world trade to grow at 9.5 per cent in 2021 and 5.6 per cent in 2022.

- In 2021 cargo demand is expected to exceed pre-COVID-19 crisis (2019) levels by 8 per cent.

- In 2022 cargo demand is expected to exceed pre-COVID-19 crisis (2019) levels by 13 per cent.

Revenue and yield

Overall revenues in 2021 are expected to grow by 26.7 per cent compared to 2020 to $472 billion (similar to 2009 levels). Further growth of 39.3 per cent in 2022 will see industry revenues rise to $658 billion (similar to 2011 levels).

- The passenger business will contribute $227 billion to industry revenues in 2021, rising to $378 billion in 2022. Passenger yields declined each year between 2012 and 2020. In 2021 yields are expected to grow by 2.0 per cent and a further 10 per cent in 2022.

- Cargo revenues are expected to rise to a record $175 billion in 2021 with a similar $169 billion expected in 2022. Cargo yields are expected to grow by 15 per cent in 2021 but decline by 8 per cent in 2022.

Costs

Airlines achieved aggressive cost reductions having reduced overall expenses by 34 per cent in 2021 compared to 2019. Costs, however, will rise in 2022 and will be only 15 per cent lower compared with pre-COVID-19 crisis levels with expanded operations and higher fuel prices.

- The price of jet kerosene was the only respite for airlines in 2020. It fell to $46.6/barrel in 2020 from $77/barrel in 2019. Kerosene prices increased to an average of $74.5/barrel in 2021 and are expected to rise further to $77.8/barrel in 2022.

- Non-fuel unit costs rose 19 per cent in 2020 compared to 2019, as fixed costs had to be spread over a dramatically smaller capacity base. This will partially reverse in 2021 with an 8 per cent reduction from 2020 levels. Capacity growth will spread fixed costs more broadly while cost cutting efforts continue. In 2022, we expect a 2 per cent increase.

Vaccinations

Vaccinations are proving to be a key driver for government relaxation of border control measures. Quick progress, with some exceptions, of vaccine distribution in developed economies is progressively giving governments the confidence to re-open borders and people the confidence to travel. Parts of the world with slower vaccine distribution (developing economies and some developed economies in Asia Pacific) will take longer to see an industry recovery.

Regional performance

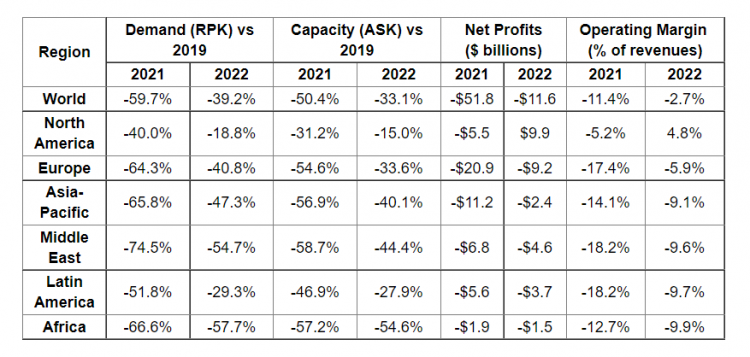

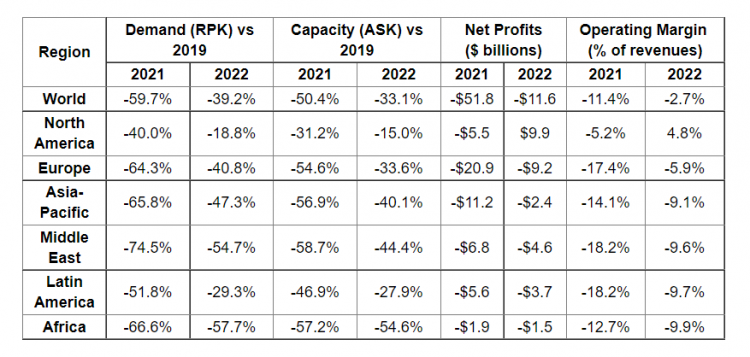

Credit: IATA

All regions will improve their collective financial performance compared to 2020. The strongest performing region is North America, which is expected to see a $5.5 billion loss in 2021 transform to a $9.9 billion profit in 2022. All other regions will see reduced losses in 2022 compared to 2021.

- North American carriers are expected to outperform other regions on the back of fast recovery of the U.S. domestic market. The opening of the U.S. market to vaccinated travellers from November 2021 will progress the recovery to international markets. The U.S. industry started to turn cash-positive in the second quarter of 2021 and will be the only region in positive financial territory in 2022 with an expected $9.9 billion profit.

- European carriers will see their losses cut from $20.9 billion in 2021 to $9.2 billion in 2022. Shifting rules and confused application of EC recommendations across EU compromised the expected positive impact of rising vaccination rates and establishment of the European Digital COVID Certificate. Better coordination between governments is expected to see a broader opening of international markets in the months ahead, boosted significantly by the re-establishment of transatlantic travel for vaccinated travellers. Long-haul demand, however, will significantly lag behind the recovery in intra-European travel.

- Asia-Pacific carriers are expected to see losses diminish from $11.2 billion in 2021 to $2.4 billion in 2022. The region continues to suffer some of the most draconian travel restrictions. While there has been some alleviation in restrictions, significant improvements in international markets are not expected until later in 2022. Reduced losses are expected to be achieved on the back of large and largely open domestic markets, not least of which is China. The region’s carriers are also benefitting disproportionally from the strength of air cargo markets in which they are dominant.

- Latin American carriers will see losses cut from $5.6 billion this year to $3.7 billion in 2022. Most of the region’s markets are open, but with some notable exceptions (e.g. Argentina). The strength of the U.S.-Latin American market will be a major contributing factor to improvement. Significant restructuring costs as the regions carriers adjust to the new business realities will weigh on financial performance, keeping the region in a collective loss.

- Middle Eastern carriers will see very limited improvement in their financial performance from a $6.8 billion loss in 2021 to a $4.6 billion loss in 2022. Without large domestic markets, the region’s major carriers rely significantly on connecting traffic, especially to Asia-Pacific which has been slow to re-open to international traffic.

- African carriers will see a very slow pace of recovery in financial performance from a $1.9 billion loss in 2021 to a $1.5 billion loss in 2022. Low vaccination rates across the continent are expected to severely dampen demand throughout 2022. The slight improvement is built on the expectation of some recovery in intra-Africa travel and travel to some tourist destination with relatively higher vaccination rates.

Related topics

Aeronautical revenue, Air freight and cargo, Airside operations, COVID-19, Funding and finance, Passenger experience and seamless travel, Passenger volumes, Tourism, Workforce

Related organisations

Related regions

Africa, Asia Pacific and Oceania, Central and South America, Europe, Middle East, North America