IATA data shows how the Delta variant impacted August air traffic demand

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 6 October 2021 | International Airport Review | No comments yet

Recovery in air travel eased in August 2021, according to The International Air Transport Association’s latest report, as domestic air traffic demand is severely impacted by the Delta variant.

The International Air Transport Association (IATA) announced that the recovery in air travel decelerated in August compared to July, as government actions in response to concerns over the COVID-19 Delta variant cut deeply into domestic travel demand.

Because comparisons between 2021 and 2020 monthly results are distorted by the extraordinary impact of COVID-19, unless otherwise noted all comparisons are to July 2019, which followed a normal demand pattern.

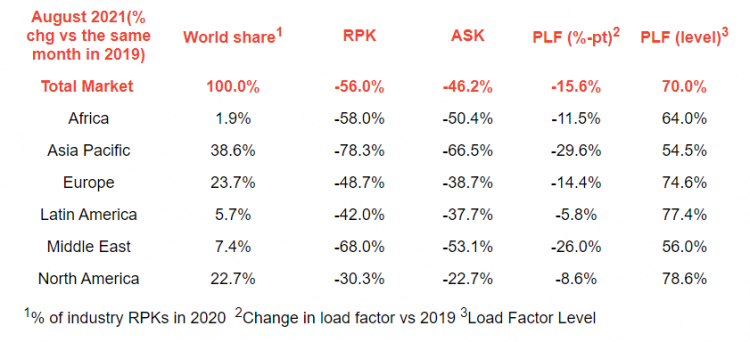

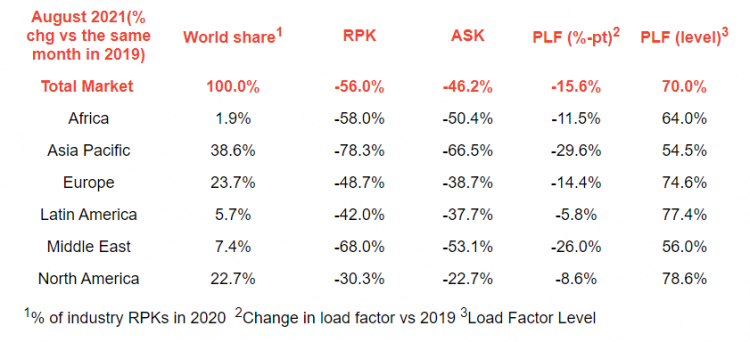

- Total demand for air travel in August 2021 (measured in revenue passenger kilometers or RPKs) was down 56.0 per cent compared to August 2019. This marked a slowdown from July, when demand was 53.0 per cent below July 2019 levels.

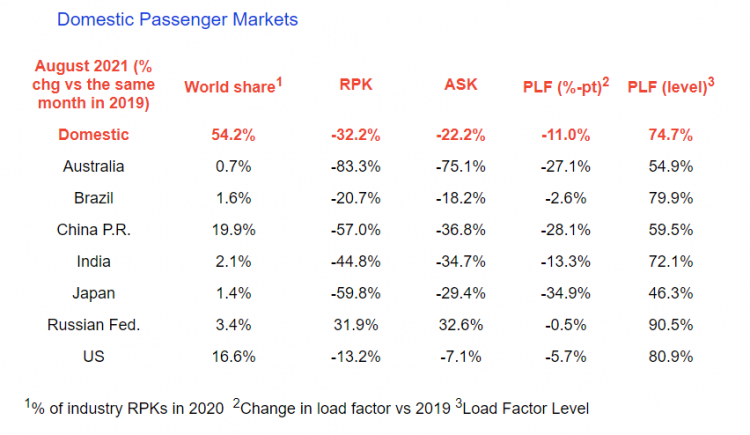

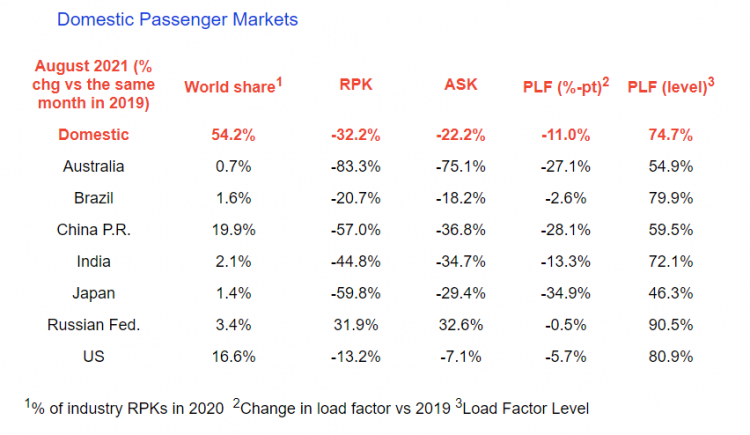

- This was entirely driven by domestic markets, which were down 32.2 per cent compared to August 2019, a major deterioration from July 2021, when traffic was down 16.1 per cent versus two years ago. The worst impact was in China, while India and Russia were the only large markets to show a month-to-month improvement compared to July 2021.

- International passenger demand in August was 68.8 per cent below August 2019, which was an improvement compared to the 73.1 per cent decline recorded in July. All regions showed improvement, which was attributable to growing vaccination rates and less stringent international travel restrictions in some regions.

Willie Walsh, IATA’s Director General said: “August 2021 results reflect the impact of concerns over the Delta variant on domestic travel, even as international travel continued on a snail’s pace toward a full recovery that cannot happen until governments restore the freedom to travel. In that regard, the recent U.S. announcement to lift travel restrictions from early November 2021 on fully vaccinated travellers is very good news and will bring certainty to a key market. But challenges remain, September 2021 bookings indicate a deterioration in international recovery. That’s bad news heading into the traditionally slower fourth quarter.”

International passenger markets

Credit: IATA.

- European carriers’ August international traffic declined 55.9 per cent versus August 2019, significantly bettering the 63.2 per cent decrease in July compared to the same month in 2019. Capacity dropped 45.0 per cent and load factor fell 17.7 percentage points to 71.5 per cent.

- Asia-Pacific airlines saw their August international traffic fall 93.4 per cent compared to August 2019, barely improved over the 94.5 per cent drop registered in July 2021 versus July 2019 as the region continues to have the strictest border control measures. Capacity dropped 85.7 per cent and the load factor was down 44.9 percentage points to 37.9 per cent, by far the lowest among regions.

- Middle Eastern airlines had a 69.3 per cent demand drop in August compared to August 2019, improved upon the 73.6 per cent decrease in July, versus the same month in 2019. Capacity declined 55.0 per cent, and load factor deteriorated 26.2 percentage points to 56.2 per cent.

- North American carriers experienced a 59.0 per cent traffic drop in August versus the 2019 period, much improved on the 61.7 per cent decline in July compared to July 2019. Capacity sank 48.5 per cent, and load factor dipped 18.0 percentage points to 70.3 per cent.

- Latin American airlines saw a 63.1 per cent drop in August traffic, compared to the same month in 2019, improved over the 68.3 per cent decline in July compared to July 2019. August capacity fell 57.3 per cent and load factor dropped 11.4 percentage points to 72.6 per cent, which was the highest load factor among the regions for the 11th consecutive month.

- African airlines’ traffic fell 58.5 per cent in August versus two years’ ago, somewhat improved over the 60.4 per cent decline in July compared to July 2019. August capacity was down 50.1 per cent and load factor declined 12.7 per cent to 63.0 per cent.

Domestic passenger markets

Credit: IATA.

- China’s domestic traffic dropped 57.0 per cent compared to August 2019 – a huge deterioration from the 2.5 per cent fall in July. However, overall cases were low, and outbreaks were mostly under control by the end of August, suggesting numbers will improve in September.

- India’s domestic traffic reversed the trend, as demand fell 44.8 per cent in August, improved from a 58.9 per cent decline in July versus July 2019, owing to positive trends in new cases and vaccination.

The bottom line

“The rapid slowdown in the domestic traffic recovery in August, owing to a spike in the Delta variant shows how exposed air travel continues to be to the cycles of COVID-19. For governments that should send two messages. The first is that this is not the time to step away from continuing support of the industry, both financial and regulatory. The second is the need to apply a risk-based approach to managing borders – as passengers are already doing in making their travel decisions,” added Walsh.

Next week (4 to 10 October 2021), leaders of the global aviation community will gather in Boston at the 77th IATA Annual General Meeting (AGM) and World Air Transport Summit, 3 to 5 October 2021.

Related topics

Airside operations, COVID-19, Passenger experience and seamless travel, Passenger volumes

Related organisations

Related regions

Africa, Asia Pacific and Oceania, Central and South America, Central and South Asia, Europe, Middle East, North America