Aéroports de Montréal announces financial results up to September 2021

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 3 November 2021 | International Airport Review | No comments yet

Aéroports de Montréal has released results for the nine months leading up to 30 September 2021, alongside passenger traffic data gathered at Montréal-Trudeau International Airport.

ADM Aéroports de Montréal has announced its consolidated operating results for the nine months ended 30 September 2021. These results are accompanied by passenger traffic data for Montréal-Trudeau International Airport (YUL).

Highlights

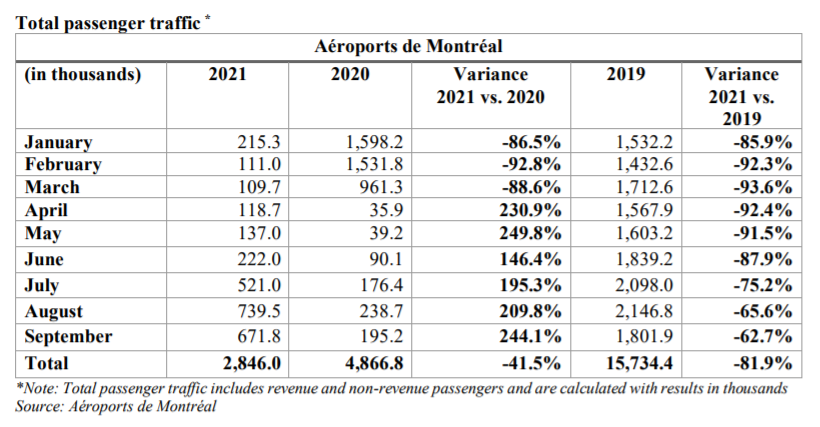

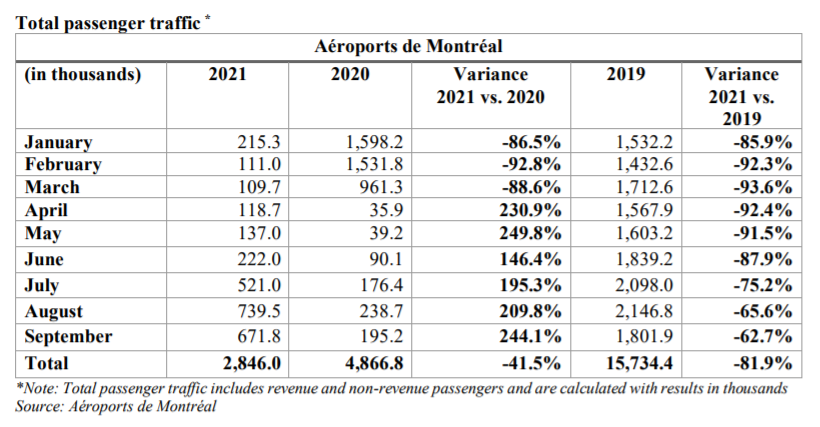

Passenger volume at YUL totalled 1.9 million passengers during the third quarter of 2021, an increase of 216.6 per cent compared with the same period in 2020 and a decrease of 68.0 per cent compared with 2019. For the nine months ended 30 September 2021, passenger traffic was 2.8 million passengers, down 41.5 per cent from the same period in 2020 and down 81.9 per cent from the same period in 2019.

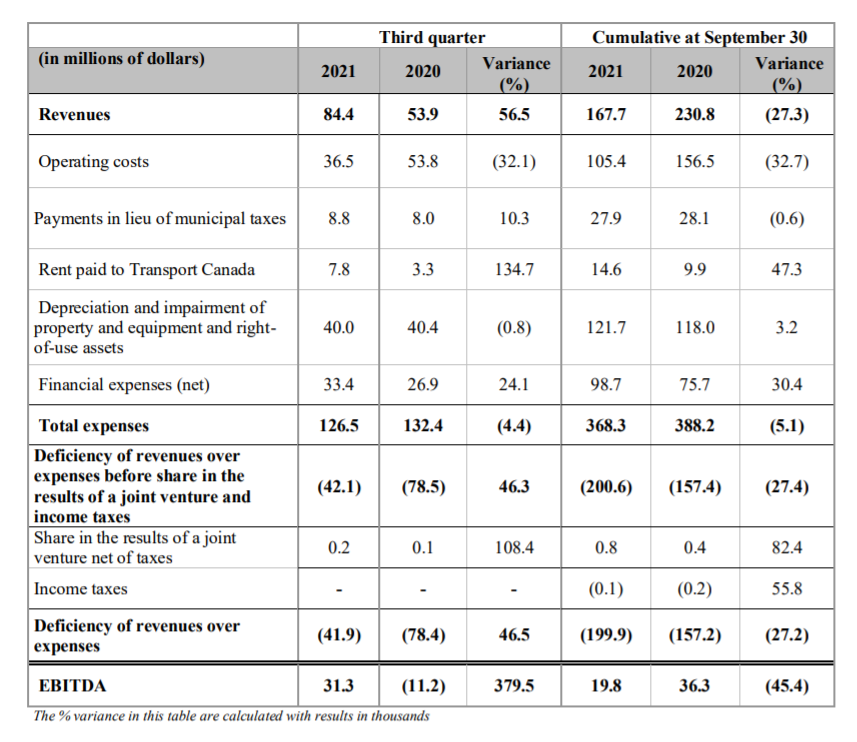

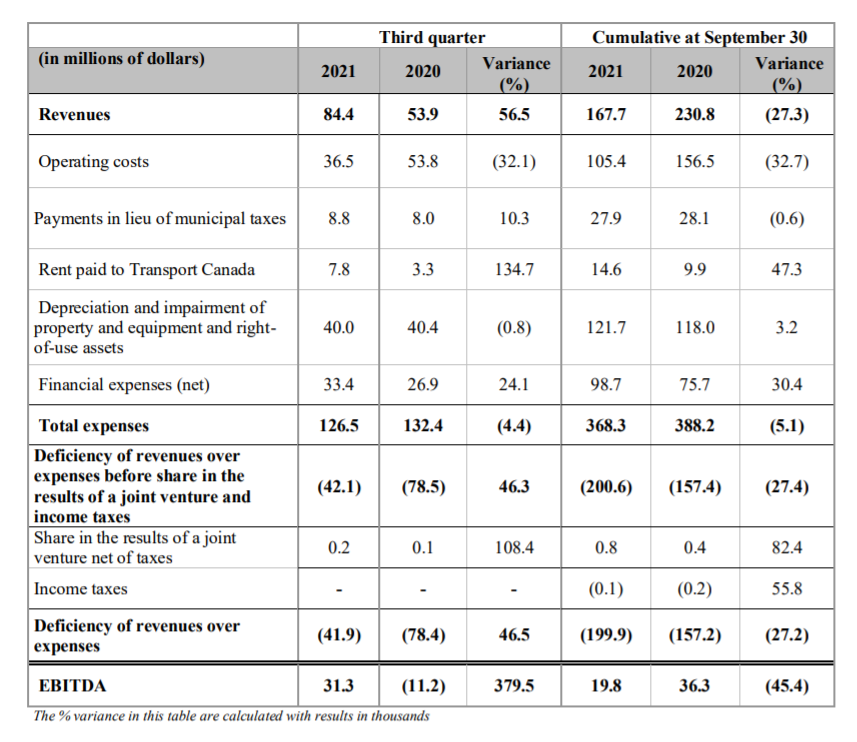

EBITDA (the excess of revenues over expenses before financial expenses, taxes, depreciation, impairment and share in the results of a joint venture) was $31.3 million for the three months ended 30 September 2021, an improvement of $42.5 million, or 379.5 per cent, compared with negative EBITDA of $11.2 million for the corresponding period in 2020. For the nine months ended 20 September 2021, EBITDA was $19.8 million, a decrease of $16.5 million, or 45.4 per cent, compared with 2020.

ADM’s capital investments, reduced to the essentials, were $13.9 million in the third quarter of 2021 and $44.2 million for the first nine months of 2021 ($42.6 million and $202.9 million, respectively, in 2020). The investments at YUL and YMX were funded by long-term debt.

Quote

Philippe Rainville, President and CEO of ADM Aéroports de Montréal commented: “While times are still challenging for ADM, the results of this third quarter are encouraging and show some resurgence in activity at YUL. The past few months have shown us that passengers are becoming increasingly comfortable with the idea of travel and traffic volumes at our facilities during the summer season exceeded our initial projections. We are definitely optimistic about the future of our industry. The federal government’s announcement requiring both travellers and workers in the industry to be vaccinated will reinforce the safe and sustainable resumption of flight operations. In the meantime, the employees of ADM and the airport community continue to do their utmost on a daily basis to properly welcome passengers and offer them an experience worthy of our international airport and our city.”

Financial results

Consolidated revenues for the third quarter of 2021 were $84.4 million, an increase of $30.5 million, or 56.5 per cent, from the same period in 2020. Cumulative revenues at 30 September 2021 were $167.7 million, a decrease of $63.1 million, or 27.3 per cent, from 2020. The results for the third quarter of 2021 indicate that a gradual recovery in passenger traffic has begun. However, the impact of the travel restrictions imposed in many countries since March 2020 due to the COVID-19 pandemic, as well as the strategy put in place in Canada to manage it, mean that year-to-date revenues as at 30 September 2021 were lower than in the corresponding period of 2020.

Operating expenses for the quarter under review were $36.5 million, a decrease of $17.3 million, or 32.1 per cent, compared with the same period in 2020. For the nine months ended 30 September 2021, operating expenses decreased by $51.1 million, or 32.7per cent, from $156.5 million to $105.4 million. ADM has continued to focus on significant operating cost reduction measures including the reduction of airport activities and the temporary closure of certain areas of the terminal building by gradually reopening these spaces based on passenger traffic. Furthermore, in 2021, ADM did not have to grant rent relief to certain concessionaires as it did in 2020 due to the impact of the COVID-19 pandemic. Finally, ADM continues to take advantage of the Canada Emergency Wage Subsidy programme, which has been in place since March 2020.

Transfers to governments (payments in lieu of taxes to municipalities and rent to Transport Canada) amounted to $16.6 million for the third quarter of 2021 and $42.5 million for the first nine months of 2021 ($11.3 million and $38.0 million, respectively, in 2020). The increase is primarily due to the rent waiver for the period of March to December 2020. Note that the 2021 rent payment to Transport Canada is deferred and will be payable over a ten-year period beginning in 2024.

Depreciation and impairment of property and equipment and right-of-use assets remained stable at $40.0 million in the three months ended 30 September 2021. These charges were $121.7 million in the first nine months of 2021, an increase of $3.7 million, or 3.2 per cent, over the same period in 2020. This increase is primarily due to the commissioning of new assets.

Net financial expenses totalled $33.4 million in the third quarter of 2021, up $6.5 million, or 24.1 per cent, over the same quarter in 2020. Cumulative net financial expenses as at 30 September 2021 totalled $98.7 million compared with $75.7 million the previous year, an increase of $23.0 million, or 30.4 per cent. The increase in net finance expenses was primarily due to higher interest expense as a result of the April 2020 and April 2021 Series R and S bond issues, respectively, as well as costs associated with the consent process completed in March 2021 with bondholders.

For the three months ended 30 September 2021, the deficiency of revenues over expenses was $41.9 million, an improvement of $36.5 million, or 46.5 per cent, over the deficiency of $78.4 million for the same period in 2020. As at 30 September 2021, the deficiency of revenues over expenses was $199.9 million, declining by $42.7 million, or 27.2 per cent, compared with the corresponding nine months in 2020.

Credit: ADM Aéroports de Montréal

EBITDA is a financial measurement that is not recognised by International Financial Reporting Standards (IFRS). It is therefore unlikely to be comparable to similar measures used by other entities that are not airports. EBITDA is defined by ADM as the excess of revenues over expenses before financial expenses, taxes, depreciation, impairment, and share in the results of a joint venture. It is used by management as an indicator to evaluate operational performance. EBITDA is meant to provide additional information and is not intended to replace other performance measures prepared under IFRS.

Passenger traffic

Passenger volumes at YUL totalled 1.9 million in the third quarter of 2021, an increase of 216.6 per cent compared with the same period in 2020. There was an increase in all the three sectors – domestic, trans border and international – of 170.2 per cent, 681.2 per cent, and 215.5 per cent, respectively.

For the first nine months of 2021, traffic at YUL totalled 2.8 million passengers, a decrease of 41.5 per cent compared with 2020. International traffic decreased by 55.1 per cent, trans border (U.S.) traffic declined by 59.2 per cent, while domestic traffic decreased by 14.9 per cent compared with 2020.

Compared with 2019, the third quarter saw a decrease of 68.0 per cent, and for the first nine months of the year, a decrease of 81.9 per cent was observed.

Credit: ADM Aéroports de Montréal

Related topics

Air traffic control/management (ATC/ATM), Airport crisis management, Airport development, COVID-19, Funding and finance, Passenger experience and seamless travel, Passenger volumes