IATA data outlines decline in global air cargo demand in April 2020

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 3 June 2020 | International Airport Review | No comments yet

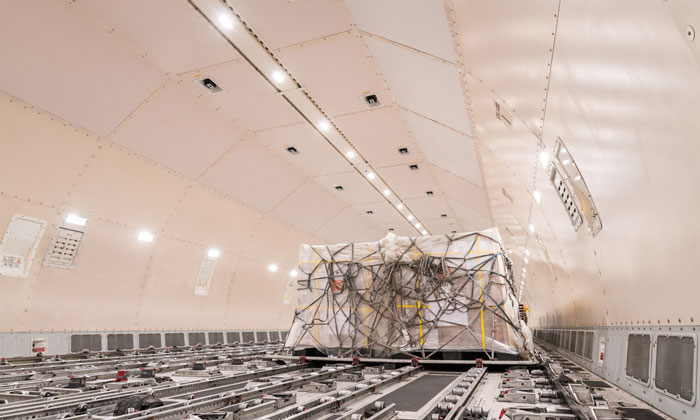

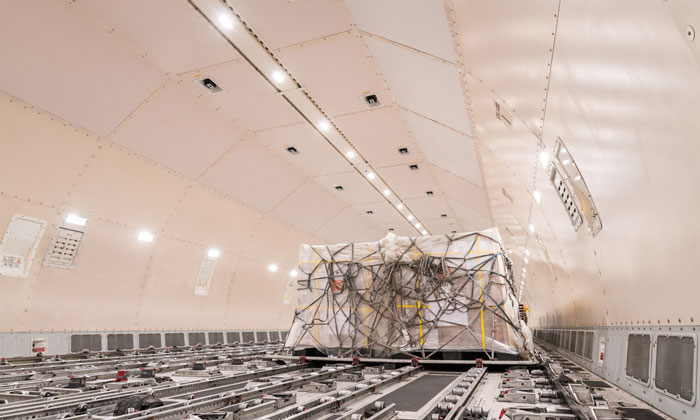

The decline has been attributed to insufficient capacity to meet demand following the loss of belly cargo operations on passenger aircraft.

The International Air Transport Association (IATA) has released data for global air cargo markets in April 2020, outlining that demand fell by 27.7 per cent compared to the same period in 2019 – the sharpest fall ever recorded. However, this was a result of insufficient capacity to meet demand following the loss of belly cargo operations on passenger aircraft due to the COVID-19 crisis causing a fall in passenger air traffic.

Global demand, measured in cargo tonne kilometres (CTKs), fell by 27.7 per cent in April 2020, compared to 2019, with a decline of 29.5 per cent for international markets. Global capacity, measured in available cargo tonne kilometres (ACTKs), shrank by 42 per cent in April 2020 compared to the previous year, with international markets experiencing a fall of 40.9 per cent.

However, belly capacity for international air cargo shrank by 75 per cent in April 2020, compared to the previous year. This was partially offset by a 15 per cent increase in capacity through expanded use of freighter aircraft. The cargo load factor (CLF) rose 11.5 per cent in April 2020, the largest increase since tracking began. The magnitude of the rise suggests that there is significant demand for air cargo which cannot be met owing to the cessation of most passenger flights.

Alexandre de Juniac, IATA’s Director General and CEO, said: “There is a severe capacity crunch in air cargo. Demand fell by 27.7 per cent compared to April 2019. But capacity was down by 42 per cent because of the sharp cuts in passenger operations, which also carry cargo. The result is damaging global supply chains with longer shipping times and higher costs. Airlines are deploying as much capacity as possible, including special charter operations and the temporary use of passenger cabins for cargo. Governments need to continue to ensure that vital supply lines remain open and efficient. While many have responded with speed and clarity to facilitate the movement of cargo, government red-tape – particularly in Africa and Latin America – is preventing the industry from flexibly deploying aircraft to meet the demands of the pandemic and the global economy.”

Delays in getting operational permits issued, blockages at the border and inadequate ground infrastructure to/from and within airport environments continue to hamper air cargo in countries in Africa and Latin America. Air cargo needs to move efficiently throughout the entire supply chain to be effective.

IATA urges governments to:

- Accelerate approvals for cargo operations

- Expedite customs clearance for urgently needed medical supplies

- Ensure there is adequate staff on the ground and land-based infrastructure to move cargo efficiently.

Regional impact

Asia-Pacific airlines saw demand for international air cargo fall by 28.1 per cent in April 2020, compared to the same period in 2019. However, the large Asia-North America market recorded less of a decline (7.3 per cent) due to the rise in movement of personal protective equipment (PPE). International capacity decreased by 42.5 per cent.

North American carriers reported a fall in international demand of 20.1 per cent year-on-year in April 2020. This was the smallest contraction of all regions. While still a significant drop, it remains less than the decline seen at the height of the Global Financial Crisis in April 2009 (32.3 per cent). International capacity decreased 27.7 per cent.

European carriers reported a 33.8 per cent annual drop in international cargo volumes in April 2020, much sharper than the outcome for March (18.5 per cent). However, the large Europe-Asia market recorded less of a decline due to the rise in movement of PPE. International capacity decreased 46.9 per cent.

Middle Eastern carriers reported a decline of 36.2 per cent year-on-year in April 2020, significantly worse than the 14.1 per cent fall in March 2020. Despite a number of carriers in the region maintaining some cargo capacity, traffic on all key routes was low. International capacity decreased 42.4 per cent.

Latin American carriers posted the sharpest fall – a 38.9 per cent year-on-year decline in international demand. International capacity decreased 55.5 per cent. The COVID-19 crisis is particularly challenging for airlines based in Latin America, owing to strict containment measures and a lack of support from governments to keep cargo moving.

African airlines were less affected by disruptions from COVID-19 than other regions in April 2020. They saw year-on-year international CTKs fall by 20.9 per cent. The small Africa-Asia market was the most resilient route in April, down only one per cent. International capacity decreased 36.6 per cent.

Related topics

Aeronautical revenue, Air freight and cargo, Airside operations, Capacity, COVID-19