A vintage year with air passenger traffic growth of 8.5%

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 6 February 2018 | Airports Council International (ACI) Europe | No comments yet

European airport trade association releases its traffic report for December, Q4, H2 and Full Year 2017.

This is the only air transport report which includes all types of airline passenger flights to, from and within Europe: full service, low cost, charter and others.

- Fastest passenger traffic growth in 13 years reported during 2017

- Biggest gains were at non-EU airports and in the Eastern & Southern parts of EU

- Top five European airports welcomed an additional 18 million passengers

- Passenger traffic growth up 30 per cent over the past five years

- Airport capacity constraints becoming more widespread & evident

- Q4 traffic growth lower, mainly due to airline disruptions, but still a robust European passenger traffic growth average of +6.9 per cent

“It was a very good year”

Passenger traffic across the European airport network grew by +8.5 per cent in 2017. Both the return of a growth dynamic in the non-EU market and the continued expansion of passenger volumes in the EU contributed to this exceptional performance. Passenger traffic at non-EU airports posted an average increase of +11.4 per cent (compared to a decrease of -0.9 per cent in 2016), with Russian and Turkish airports enjoying a bounce back. Airports in Georgia, Ukraine, Moldova and Iceland grew in excess of +20 per cent on average.

Meanwhile, EU airports saw passenger traffic increasing by +7.7 per cent, a further improvement over 2016 (+6.7 per cent). The highest growth was achieved by airports in East and South of the EU – with airports in Latvia, Estonia, Poland, the Czech Republic, Slovakia, Hungary, Croatia, Slovenia, Romania, Bulgaria, Cyprus, Malta and Portugal recording double digit growth. This reflects a catching-up pattern in terms lower propensity to fly in most of these countries when compared to the Western and Northern parts of the EU, along with more dynamic local economies.

Olivier Jankovec, Director General of ACI EUROPE said “2017 marks the best year for European airports since 2004, when air traffic was boosted by the accession of 10 countries to the EU – the single largest expansion of the bloc. That parallel is quite something when you consider the current climate includes Brexit and all its uncertainties.”

He added “This performance comes on top of several years of dynamic growth and shows that demand for air transport keeps outperforming the economy and defying geopolitical risks – for now. It is quite impressive to see that even in the more mature EU market, passenger traffic since 2012 has increased by close to +30 per cent. Such significant growth is putting much pressure on airport facilities and staff with more and more airports now reaching their capacity limits – especially during peak hours.”

Freight foot forward & majors improving

Freight traffic across Europe’s airports grew by +8.5 per cent in 2017 – reflecting a cycle of sustained and synchronised expansion in the Global economy and in Europe in particular. Aircraft movements increased by +3.8 per cent, on the back of continued airline capacity expansion. The top five European airports (‘the Majors’) saw passenger traffic growing by +5.5 per cent in 2017 – collectively welcoming an additional 18 million additional passengers. This significantly improved performance compared to the preceding year (+1.5 per cent in 2016) reflects both the continued expansion of Low Cost Carriers (LCCs) in primary markets and the better fortunes of these airports’ hub carriers.

Among the Majors, Amsterdam-Schiphol grew at the fastest pace (+7.7 per cent), confirming its third position with 68.5 million passengers, just behind Paris Charles de Gaulle (69.5 million passengers, +5.4 per cent). Meanwhile, London-Heathrow remained the busiest European airport with 78 million passengers (+3 per cent). Frankfurt airport posted the second best performance (+6.1 per cent, 64.5 million passengers) and held onto its 4 position, followed by Istanbul-Atatürk (+5.9 per cent, 63.9 million passengers). This ranking is likely to change in 2018 as Amsterdam-Schiphol has now reached its capacity limits and growth at Istanbul-Atatürk is accelerating (+15.9 per cent in December).

The fast & furious

Beyond the Majors, the fact that since 2012 the number of European airports with more than 25 million passengers has jumped from 14 to 24 is pointing to increasing competition amongst larger airports and hubs. More generally, the impressive performance of a number of individual airports over the same period is also testimony of widespread airport competition. These include: Keflavik (+267.7 per cent), Istanbul-Sabiha Gocken (+105.2 per cent), Split (+98.1 per cent), Sofia (+87.1 per cent), Luxembourg (+87 per cent), Eindhoven (+89.9 per cent), Berlin SXF (+81.3 per cent), Oporto (+78.3 per cent), Lisbon (+74.3 per cent), Athens (+67.9 per cent), Malta (+65.1 per cent), Warsaw WAW (+64.3 per cent), Dublin (+54.9 per cent), London-Stansted (+48.3 per cent), Naples (+47.8 per cent), Birmingham (+45.5 per cent), Bordeaux (+40.5 per cent), Barcelona (+34.5 per cent) and Amsterdam-Schiphol (+34.3 per cent).

Passenger traffic growth moderated in Q4 (+6.9 per cent) and December (+5 per cent) as result of airline-related disruptions, especially the demise of Monarch and Air Berlin as well as the decision of Ryanair to slow down its growth to solve its crew rostering issues.

Wither 2018?

Looking ahead, Jankovec commented “This might be as good as it gets and while we anticipate continued growth in the coming months, it will most certainly come at a slower pace. The good news is that the European economy and the Eurozone in particular are set for further expansion – with economic sentiment now close to a 17-year high. But on the flip side, rising oil prices are affecting airlines and consolidation is now placing more market share with a handful of powerful airline groups. Couple that with the fast-approaching Brexit deadline on the horizon and it’s not hard to see why Europe’s airports can expect the temperature to rise, as airlines get even choosier about where they maintain existing capacity or open new routes.”

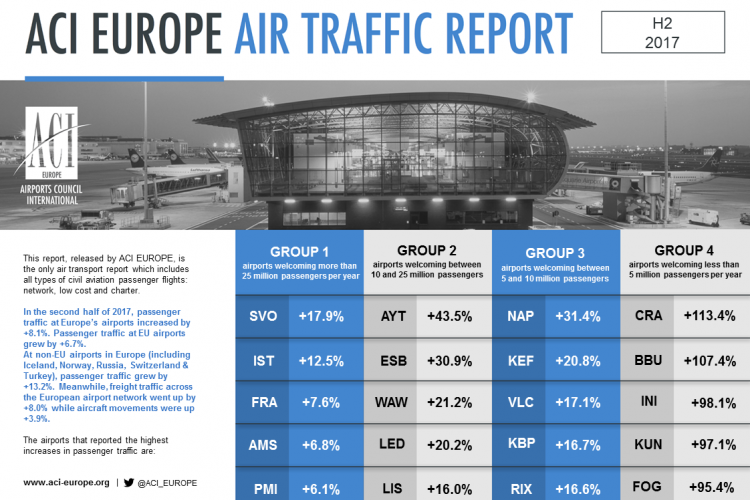

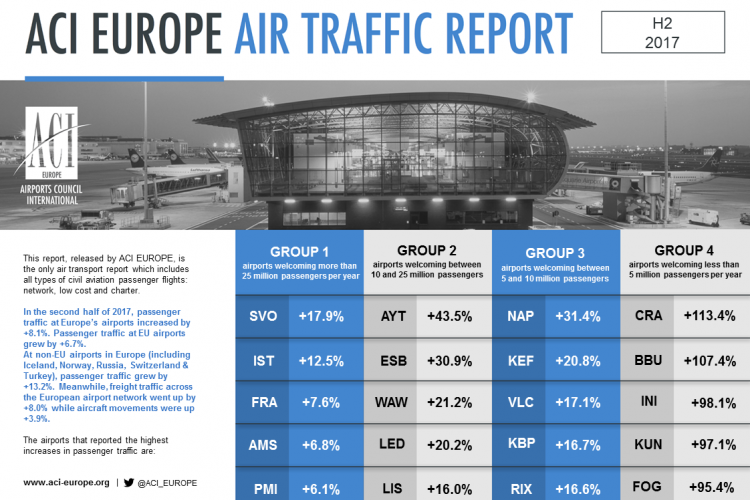

Traffic categories & highest increases 2017

During the full year of 2017, airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between five and 10 million passengers (Group 3) and airports welcoming less than five million passengers per year (Group 4) reported an average adjustment +5.6 per cent, +11.3 per cent, +10.2 per cent and +10.9 per cent.

The airports which reported the highest increases in passenger traffic during 2017 (compared with 2016) are as follows:

GROUP 1: Moscow SVO (+17.8 per cent), Manchester (+8.6 per cent), Amsterdam (+7.7 per cent), Moscow DME (+7.6 per cent) and Barcelona (+7.1 per cent)

GROUP 2: Antalya (+38.0 per cent), St Petersburg and Warsaw WAW (+22.7 per cent), Ankara (+20.6 per cent), Lisbon (+18.8 per cent) and Prague (+17.9 per cent),

GROUP 3: Keflavik (+28.3 per cent), Naples (+26.6 per cent), Kiev (+22.1 per cent), Malta (+17.5 per cent) and Larnaca (+16.5 per cent)

GROUP 4: Bucharest BBU (+208.9 per cent), Nis (+167.8 per cent), Craiova (+100.6 per cent), Batumi (+67.2 per cent) and Kaunas (+60.2 per cent)

During the month of December, airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between five and 10 million passengers (Group 3) and airports welcoming less than five million passengers per year (Group 4) reported an average adjustment +3.6 per cent, +4.6 per cent, +6.8 per cent and +9.5 per cent.

The airports which reported the highest increases in passenger traffic during December 2017 (compared with December 2016) are as follows:

GROUP 1: Istanbul IST (+15.9 per cent), Moscow SVO (+13.8 per cent), Palma De Mallorca (+11.7 per cent), Frankfurt (+7.3 per cent) and Barcelona (+6.4 per cent)

GROUP 2: Ankara (+28 per cent), Tel Aviv (+18.3 per cent), Izmir (+17.7 per cent), Lisbon (+15.7 per cent) and Warsaw WAW (+14.3 per cent)

GROUP 3: Naples (+39.5 per cent), Ibiza (+22.2 per cent), Valencia (+22 per cent), Palermo (+18.7 per cent) and Riga (+18.3 per cent)

GROUP 4: Bourgas (+6455.8 per cent), Foggia (+104.5 per cent), Varna (+81.3 per cent), Craiova (+69.4 per cent) and Liège (+49.9 per cent)

The ‘ACI EUROPE Airport Traffic Report – December, Q4, H2 & Full Year 2017’ includes 252 airports in total representing more than 88 per cent of European air passenger traffic.

Related topics

Economy, Passenger experience and seamless travel, Passenger volumes