UK exit from the EU and its impact on the UK aviation industry

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 12 September 2018 | Bob Simmons | No comments yet

With Brexit just around the corner, and a no-deal scenario edging closer, Bob Simmons, Technical Director at Baines Simmons, takes us through the possibilities of air travel in a post-Brexit Britain.

Following the publication of the UK Government’s whitepaper, titled ‘The Future relationship between the UK and the EU’, some clarity has started to emerge on the direction that the UK Government is taking with Brexit negotiations and its impact on aviation entities based in the UK.

This paper aims to capture the latest policy positions and agreements as they emerge and discusses their potential impact on UK aviation.

Despite the clarity that is starting to emerge on the UK’s position and an increasing sense of urgency, there remains consensus between the UK and EU that ‘nothing is agreed until everything is agreed’, raising the spectre that clarity on the final agreements affecting aviation will not be achieved until quite late in the day.

Background

The UK has voted to leave the European Union. It is scheduled to depart at 11pm UK time on Friday 29 March 2019. The UK and EU provisionally agreed on the three “divorce” issues of how much the UK owes the EU, what happens to the Northern Ireland border and what happens to UK citizens living elsewhere in the EU and EU citizens living in the UK. Talks have now moved on to future relations – after agreement has been reached on a 21-month “transition” period, expiring on 31st December 2020, to smooth the way to post-Brexit relations. However, if an agreement cannot be achieved before the Article 50 deadline on 29th March 2019, a ‘Hard Brexit’ under WTO rules will immediately come into effect and the transition period will not occur.

Political level agreements on the principles of the four freedoms, the authority of the European Court of Justice, the Irish border, Customs and Air Service Agreements will have a major impact on the regulatory system and, obviously, cross border trade and even the UK’s future relationship with the European Aviation Safety Association (EASA) as either a non-voting member or completely disconnected.

EASA stated: “As the withdrawal and transitional agreement negotiations are currently underway EASA cannot yet determine the ultimate impact of the withdrawal on EASA or its stakeholders within the EU-27 and four associated countries or within the UK. The withdrawal will significantly alter EASA’s cooperation with UK authorities and will not leave EASA’s stakeholders untouched.” (https://www.easa.europa.eu/brexit-negotiations)

Scope & objectives

The most significant impact of Brexit in the aviation sector will be felt by those UK entities and EU citizens flying between the UK and EU member states, trading with customers across the EU’s new outer border and potentially, those currently holding EASA regulatory approvals. Open skies arrangements in particular will influence UK airline business registration jurisdiction decisions and their ability to freely trade with EU-27 based entities and citizens.

The objective of this paper is to explore the impact of Brexit on aviation entities and to capture relevant UK Government proposals. With any change of the magnitude of Brexit, comes both risk and opportunity and whilst Brexit brings significant uncertainty and potential harm to UK businesses, there may also be opportunities for those to exploit any opportunities presented by the resultant agreements.

The general direction of travel

Aviation specific arrangements and companies’ ability to trade will be heavily influenced by higher level political, trade and customs agreements and despite the recent publication of the UK Government’s White Paper on their vision and negotiating position for the future UK/EU relationship, it will be some time before the likely outcome of the negotiations becomes clear. At the time of the development of this paper, the following aviation relevant high-level statements, policy and negotiating positions have been identified as likely to affect the future shape of the UK/EU relationship.

Source website links are included in Annex 1, below.

The future relationship between the United Kingdom and the European Union

This whitepaper, dated 12 July 2019, sets out the government’s proposal for the future relationship between UK/EU and includes a number of aviation specific clauses along with the more general business arrangements for companies providing services, such as maintenance organisations. Disappointingly, there seems to be little focus on ensuring the ‘frictionless provision of services’ compared with those proposed for goods and agricultural produce. In particular, the positions for services are summarised in the paper as follows;

‘These close arrangements on goods should sit alongside new ones for services and digital, giving the UK the freedom to chart its own path in the areas that matter most for its economy. The Government wants to minimise new barriers to trade between the UK and the EU, and hopes that both sides will work together to reduce them further over time – but acknowledges that there will be more barriers to the UK’s access to the EU market than is the case today.’ (Whitepaper Page 7)

The aviation content of the whitepaper can be summarised as follows;

- Within the section on the provision of authorisations for goods, the UK government wishes to continue to participate in EASA, whilst recognising that the UK will need to accept the Agency’s rules and contribute to costs. (page 8)

- To meet the objective of the single, common approval of products for both markets, it is recognised that EASA membership as a Third Country, without voting rights, is essential. This mirrors the EASA membership of Switzerland, under Article 66 of the Basic Regulation. (Part 1.2.3 para 30. Pages 21/22)

- Building on other precedents set by the EU, the UK aims to secure an Air Transport Agreement that ensures liberalised aviation access, alongside EASA membership. This measure aims to secure access to EU member state airspace for operators (Part 1.7 para 128 Page 41)

- An Aviation specific paragraph makes the case for;

- Continued or increased travel connectivity for citizens Para 129

- Rules on Air Operator Ownership and Control that avoid additional barriers – Para 130.

- Collective work on Aviation Safety standards and reducing regulatory barriers continuing through EASA membership Para 131.

- Close cooperation on Air traffic management, security and emissions to address shared threats. Para 132 (Part 1.7.1 Page 42).

- New forms of dialogue are proposed at political and technical levels aim to secure ongoing cooperation between firms, individuals and public authorities on common areas, including aviation and security. (Part 4.3 Para 9 Page 87).

- Economic and Security partnership aims will necessitate the UK’s participation in EASA to secure mutual recognition of standards, sharing expertise and personnel in addition to the exchange of data and information. (Part 4.3 Para 9 Page 87).

The general content of the whitepaper includes further proposals affecting aviation, as follows;

- The paper proposes frictionless and tariff free movement of goods, in a ‘free trade area’. ‘Goods’ are defined as ‘manufactured products’. If agreed, ideally alongside EASA membership, this would result in little impact of Brexit on Part 21 Sub-part G approved Production Organisations. By definition, design, training, continuing airworthiness management and maintenance are all likely to be classed as ‘services’ and not covered by this.

- It is proposed that mutual recognition of professional qualifications continues, to facilitate the provision of professional services by individuals and companies to be unhindered. This should include EASA licensed pilots, maintenance engineers and Air Traffic Controllers. Considering the general shortage of licensed people in aviation, we think it is unlikely that unnecessary barriers will be raised to their mobility.

The following general content affects ‘service’ businesses operation the EU27 area;

- The government proposes to agree mutually beneficial arrangements for professional and business services, with the aim of facilitating international trade. The devil will be in the detail, however this would seem to cover maintenance and training.

- Another proposal seeks to secure provisions that minimise discriminatory (anti-UK/EU) barriers to the establishment, investment and cross-border provision of services. I interpret this as meaning that organisation would be able to operate under an (EU-based) ownership model to facilitates tariff free trade. This is logical, but may be seen as ‘Cherry-picking’ and rejected by some states or the EU as a whole and blocked in principle. (But that’s just a gut feeling!).

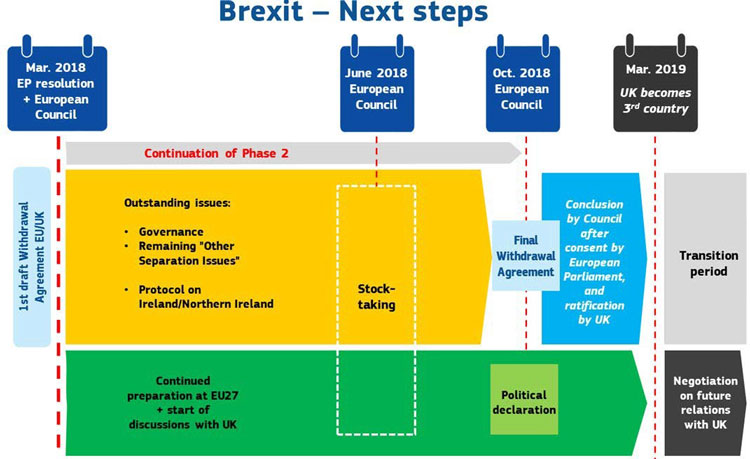

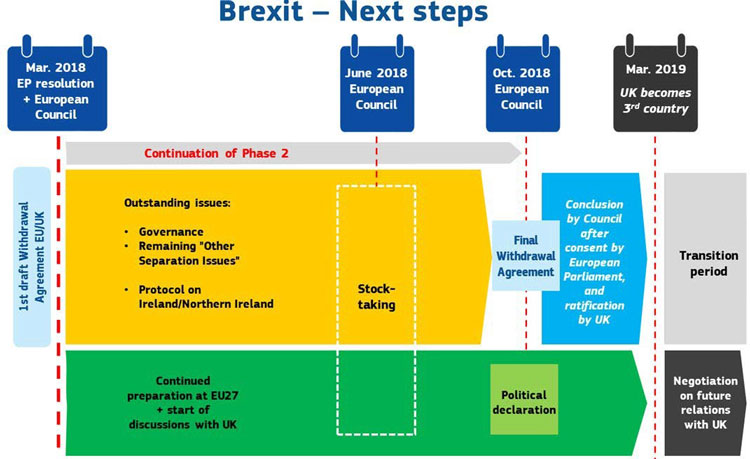

The following graphic, taken from the whitepaper, illustrates the remaining phases of the negotiation for information.

UK CAA position

The UK regulator and almost universally, the UK aviation industry are resolute in their position that it is preferable for the UK to remain members of EASA. The UK CAA has stated that it is not planning for the operation of a completely independent national regulatory system as it is not a viable option, although it is planning for all scenarios, but would implement an EASA based rule set.

European Commission Aviation Safety position paper 13 April 2018.

The EC has factually stated that as of any withdrawal date all UK CAA issued approvals, Certificates and Licences will cease to be valid under the EU system. Any certificates used by UK approved organisations will also cease to be valid (unless parts etc. are fitted to aircraft at the time). This position is driven solely by the applicability provisions of the Basic Regulation.

CAA website statement, in response to European Commission paper

The EU paper describes what the situation will be if UK does not achieve EASA membership at Brexit and no other agreements are in place, including an implementation period. While this a matter for government, we believe this to be a highly unlikely scenario. However, the CAA continues to make the necessary contingency plans.

The European Council (Art. 50) further stated that nothing was agreed until everything is agreed. This means that a transition period between 30 March 2019 and 31 December 2020 may be agreed, but this is not certain at this stage. Literally speaking, this means that we will not know the final arrangements for both UK based businesses nor aviation specific regulatory systems until everything else is agreed and this is likely to be some time before agreement.

The European Commission position paper on goods placed on the Market under Union law before the withdrawal date covers manufactured items / materials or animals reared and has no implications or alleviations for organisations providing services, such as maintenance, however new customs and arrangements will apply.

CAA Response to Financial Times article

In response to the FT‘s article, MPs warn of Brexit damage to UK aerospace, on 19 March 2018, Chief Executive of the CAA, Andrew Haines, said:

“Both the Government and the CAA have been clear that our collective preference is to remain a member of the European Aviation Safety Agency (EASA) once the UK formerly withdraws from the European Union. The international nature of aviation regulation has improved safety outcomes for passengers, and it is important we retain as much influence as possible in this global system.

“In a speech I gave in September 2017, I was clear that I believe the UK should not be planning for a new independent aviation safety system. If continued membership of EASA is unachievable, we should adopt the existing EASA regulatory system, rather than developing a new framework from scratch. This option is available to any third-party country, and is one that, I believe, would provide clarity and certainty for the aviation industry.”

In a further statement on ‘The Future of Open Skies post Brexit’,Andrew identified the following four options – that on a sliding scale of liberalisation, this would run from:

- Staying in the European Common Aviation Area (i.e. UK airline treated as if part of the EU, with full access – in many ways highly desirable for both sides in this negotiation). But aviation is likely to be caught in the crossfire – so on what conditions would this be possible and will they be potentially acceptable?

- A UK ‘open skies’ deal with Europe? (i.e. UK treated as a third country, like the USA)

- Negotiating a single bilateral agreement with the EU as a whole if Member States give the EU a mandate to negotiate on their behalf. Or the UK could still negotiate bilateral agreements with individual member states; for instance, if member states wish to or find the EU-led process too slow. (Any state that wanted to go down that route would have to notify the EU and negotiate in a way that is compatible with EU law, but this is a possible)

- Enhanced ‘UK open skies deal’ – the prospects of the UK securing better deals because of its inherent strengths than pan-European deals have.

The final arrangements will shape UK airline business models and as a result impact the trading relationship with other entities, with a possibility that some or most airlines will take a similar approach to easyJet’s contingency of creating an EU-based business and AOC (Austria).

CAA assumptions

The CAA has published the following list of assumptions which underpins it’s planning for a hard (non-negotiated) Brexit;

Planning assumptions for a non-negotiated exit

To help organisations with their own planning for EU exit, we have listed the assumptions that we (the CAA) used to develop our approach for a potential non-negotiated withdrawal from the EU in March 2019.

These assumptions are not representative of the CAA’s view of the most likely, or desirable, outcome of negotiations and do not reflect Government policy, but allow us as a responsible regulator to prepare for all possible scenarios. In a non-negotiated outcome at March 2019, we have assumed that:

- The UK leaves the EU at 11 pm on 29 March 2019

- Through the EU (Withdrawal) Act 2018, the UK adopts all European aviation laws at the point of exit. Changes will be made to ensure those laws are legally

- The UK continues to mirror EU aviation regulations for at least a two-year

- The UK withdraws completely from the EASA system in March 2019, meaning that the CAA will need to make arrangements to fulfil regulatory functions without having EASA as a technical agent and having without having access to EASA and EU- level

- The UK is no longer included in EU-level Bilateral Aviation Safety

- There is no mutual recognition agreement between the EU and the UK for aviation licenses, approvals and certificates.

- UK-issued EASA licences and approvals are no longer recognised in the EU post-EU exit

- The EU treats UK airlines as Third Country

- All licences issued by the CAA under EU legislation, and all type approval certificates and third country approvals issued by EASA under EU legislation, will continue to have validity under UK law, if they were effective immediately before exit

- The UK minimises additional requirements for licences, approvals and certificates from EU aviation and aerospace companies providing services and goods in the

Bringing EU regulation into UK law

Under a non-negotiated withdrawal scenario, a number of regulatory processes will need to be brought back within the UK system so that (UK CAA) are able to continue to regulate the UK aviation industry. This means that our preparatory work includes adjusting existing systems so that they could continue to work in exactly the same way as now – but with the UK Government and the CAA fulfilling regulatory functions independently of the EU.

EU / EASA Basic Regulation – Third Country participation (Article 66)

The following Article specifically addresses this subject – note the inclusion of application of Community Law, financial contributions and staff.

Article 66

Participation of European third countries

The Agency shall be open to the participation of European third countries which are contracting parties to the Chicago Convention and which have entered into agreements with the European Community whereby they adopted and apply Community law in the field covered by this Regulation and its implementing rules.

Under the relevant provisions of these agreements, arrangements will be developed which shall, inter alia, specify the nature and extent of, and the detailed rules for, the participation by these countries in the work of the Agency, including provisions on financial contributions and staff.

Summary

In summary, there is still a long way to go, but having survived the first round of UK Parliamentary scrutiny, challenges and votes, the whitepaper clarifies what the Government is aiming to achieve in the final negotiated agreement.

The initial response from the EU to the paper was mixed, however it seems that it has been accepted as containing some good steps forward, which will form a platform on which negotiation, compromise and eventual agreement can be achieved. Despite recent changes within the UK Cabinet and specifically the Department for Exiting the EU, Theresa May and her new minister seem to be making some progress and the EU states that it is ready to intensify negotiations.

In essence, the UK’s current position, if accepted, will have the following outcome for organisations and people within the UK, thus constituting the best outcome for each;

- Air operators: Continued open skies and a reciprocal air service agreement between the UK and EU27; continued acceptance of UK AOC’s as standardised with EU based carriers, alongside continuing membership of EASA

- Design organisations: Already directly approved by EASA, thus certification standards will continue to be acceptable within the EU, however business may be affected by trade barriers as their output likely to be considered as a service

- Production organisations (manufacturers): Output will be accepted as ‘goods’ and thus trading into the EU27 should not be affected. UK membership of EASA will ensure that UK granted Production Organisation Approvals and their certificates (Form 1) will remain acceptable

- Maintenance organisations / standalone CAMOs: Output highly likely to be treated as a ‘service’ and therefore likely to be affected by future trade barriers. Continued UK membership of EASA should ensure continued acceptance of Maintenance Certification and inclusion in the supply chain to the EU27. In the case of the stand-alone CAMO, their services should also remain acceptable for EU27-based owners (the current support of Commercial Air Transport Operators is under sub-contract arrangements and therefore, in theory, not affected by the negotiations)

- Training organisations: Output also highly likely to be treated as a ‘service’ and therefore likely to be affected by future trade barriers. Continued UK membership of EASA should ensure the acceptance of training and examination certificates along with UK CAA issued EASA licenses

- Licensed persons: Personal licenses will continue to be recognised within the EU27 and barriers minimised, as far as possible.

If no agreement is reached between the EU and the UK, or the UK Parliament rejects the agreement, then UK based EASA approved entities will need to consider applying to EASA for direct approval, where possible or reviewing their ownership and EU27 registration options. There is a possibility that continued UK membership of EASA exists outside of any higher-level agreement, although we have not explored this possibility in any depth.

We offer this paper as the Baines Simmons’ interpretation of the Government’s whitepaper, dated July 2018, and remind you that the final agreement may take a very different form – nothing is agreed until everything is agreed

Annex 1 – Resources

EU, Article 50 negotiation guidelines http://www.consilium.europa.eu/media/33458/23-euco-art50-guidelines.pdf EU Taskforce on Article 50 negotiations with the United Kingdom

https://ec.europa.eu/info/departments/taskforce-article-50-negotiations-united- kingdom_en#negotiationdocuments

https://ec.europa.eu/commission/brexit-negotiations_en

EU communication on ‘Preparing for the withdrawal of the United Kingdom from the European Union on 30 March 2019’ issued 19 July 2018.

https://ec.europa.eu/info/sites/info/files/communication-preparing-withdrawal-brexit-preparedness.pdf EU Brexit preparedness

https://ec.europa.eu/info/brexit/brexit-preparedness_enhttps://ec.europa.eu/info/brexit/brexit- preparedness_enUK Government policy (White) Paper 12/07/18

https://www.gov.uk/government/publications/the-future-relationship-between-the-united-kingdom- and-the-european-union?utm_source=e5b3260b-2069-4b57-a5bd- 24e9ea02aa88&utm_medium=email&utm_campaign=govuk-notifications&utm_content=immediate

UK Department for Exiting the European Union (DExEU)

https://www.gov.uk/government/latest?departments%5B%5D=department-for-exiting-the-european- union&utm_source=POLITICO.EU&utm_campaign=00f990c430- EMAIL_CAMPAIGN_2017_07_14&utm_medium=email&utm_term=0_10959edeb5-00f990c430- 188954337

UK CAA EU exit page

http://www.caa.co.uk/Our-work/About-us/EU-exit/

GTDT Article re. ADS and GAMA concerns and comms to Barnier. https://gettingthedealthrough.com/aviation/article/6136/trade-groups-ask-standalone-brexit-talks-caa- easa-establish-legal- certainty?utm_source=GTDT+ALN+21%2f06%2f18&utm_medium=email&utm_campaign=GTDT+A LN+21%2f06%2f18&utm_term=European+Parliament+endorses+EU- wide+drone+safety+rules+and+operator+registries&utm_content=22083&gator_td=MpzoXt%2fcq H8w9VZs3T7W0SLMcb2KHlN4T8Gde%2fnJ6IEvCobjcK5nalPKs7rFG%2fZW7YF8YDVVNEVfSTu42

49vbF3a67pVxafsuXSBjocvkl%2bF5gHvuZSvKAsoqyQO0Ye9x93XGKmE4C4WoztP6WZFADN6Vm QQQm3wbm8OMRzUPBymHK9Ly1cPiHK5KwxmXPBX

FT Article by Tom Enders – Airbus (April 10th, 2018) https://www.ft.com/content/b9ff0c10-3c9f-11e8-bcc8-cebcb81f1f90 Facts from Labour MP

https://www.ig.com/uk/shares-news/how-will-brexit-impact-airlines-and-the-wider-aviation-industry– 180316

Andrew Haines (CAA) UKTiE speech 05 September 2017.

https://www.caa.co.uk/uploadedFiles/CAA/Content/News/Speeches_files/UKTiE%20-

European Commission notice to stakeholders – withdrawal of the United Kingdom and EU aviation safety rules (13 April 2018):

https://ec.europa.eu/transport/sites/transport/files/legislation/brexit-notice-to-stakeholders-aviation- safety.pdf

European Commission Position paper on Goods placed on the Market under Union law before the withdrawal date of 12 July 2017.

https://ec.europa.eu/commission/sites/beta-political/files/essential-principles-goods_en_0.pdf CAA Response to FT Article

https://www.caa.co.uk/News/CAA-response-to-FT-article-(-MPs-warn-of-Brexit-damage-to-UK- aerospace-)/

EASA Website ‘Brexit Negotiations’ page; https://www.easa.europa.eu/brexit-negotiations

To download the pdf of this response paper, please click here.

Related topics

Aeronautical revenue, Brexit, Economy, Regulation and Legislation

Related organisations

Civil Aviation Authority (CAA), European Aviation Safety Agency (EASA), European Union (EU)