IATA 2023 forecast for CPK. Investor scenario confirms the necessity of the project

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 22 January 2024 | Centralny Port Komunikacyjny Sp. z o.o., Solidarity Transport Hub Poland | No comments yet

The Centralny Port Komunikacyjny (CPK), set to become one of Europe’s most innovative airports, is drawing attention for its unique approach to environmental management.

At the core of CPK’s uniqueness is its multimodal design, meaning that it integrates different modes of transport in one place. Poland’s geographical situation makes it easier and justified. As a result, it has the potential to completely transform the transport sector, making it more sustainable and innovative on a global scale and in many ways, implementing state-of-the-art technologies hence benefiting from the latecomers’ premium. Additionally, decarbonisation is a priority for CPK, indicating a drive to reduce CO2 emissions and environmental impact.

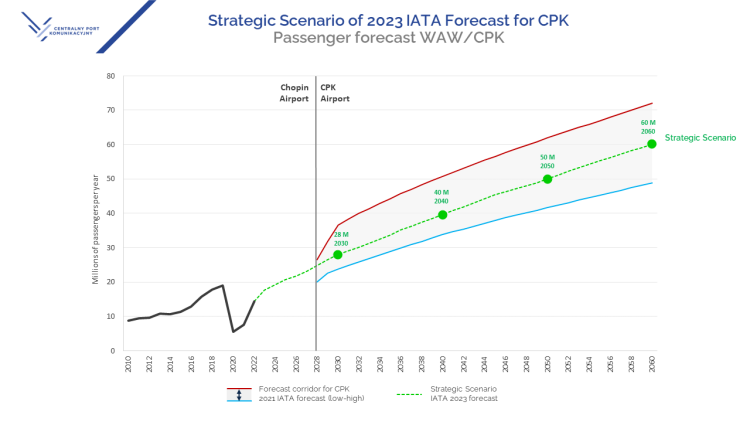

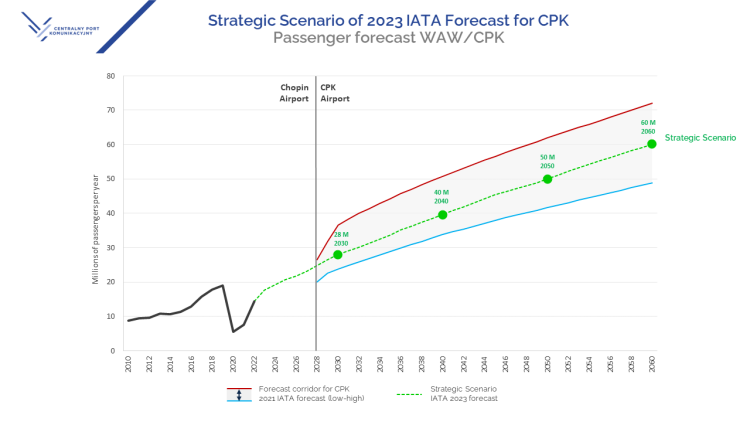

CPK is updating traffic forecasts as the project progresses, adapting to changing circumstances, such as the war in Ukraine, the COVID-19 pandemic and the environmental regulations. CPK presents this year’s latest forecast from the International Air Transport Association (IATA). It confirms that the construction of CPK is needed. Already in 2040, the new airport should be able to handle around 40 million passengers, twice as many as today’s Warsaw Chopin Airport

In 2021, IATA prepared the study Air traffic forecasts for Poland and CPK. The document set out three traffic development scenarios and at the same time confirmed the need to build a new airport to handle the growing number of passengers and cargo. In the first half of 2023, CPK decided to update the IATA forecast for the CPK airport, as part of the development of the Strategic Scenario for investors.

‘Monitoring and updating forecasts is part of good investor practice,’ says Mikołaj Wild, CEO of CPK.

As the CEO explains, CPK has been updating traffic forecasts since 2021, keeping a close eye on changes in the market environment.

‘Such action is necessary due to changes in the situation in the aviation market as a result of events such as the COVID-19 pandemic, the war in Ukraine or restrictions resulting from EU environmental regulations. In addition, the progress of project work, the assumptions we make regarding, among other things, airport charges, the level of service and the infrastructure offered, affect the interest of carriers, which is then translated into forecast results. Thanks to the updates, we have a guarantee that the infrastructure we develop is adapted to the actual demand and expectations of passengers,’ adds Mikołaj Wild.

What do we know from the latest forecasts?

There has been a rapid recovery in traffic after the COVID-19 pandemic. In the case of Warsaw Chopin Airport, it has slowed down to some extent by the effects of Russia’s invasion of Ukraine, which began after the publication of the IATA 2021 forecast. Due to the war, flights to Ukraine and Russia have been discontinued, while flight routes to Asia, which have to avoid the closed airspace, have been extended. The conflict has led to a spike in fuel prices and currency fluctuations and, above all, an increase in inflation in many countries around the world.

Together, Ukraine, Russia and Belarus accounted for approximately 7.5% of the passengers at Chopin Airport and more than 10% of the transfer traffic in Warsaw. IATA estimated that the conflict would have long-lasting consequences, with a potential recovery of the traffic with Ukraine starting in 2025 – at around 25% of the pre-conflict levels. According to IATA, the slow start of recovery of traffic to Russia and Belarus will not be possible until 2029 at the earliest. These factors mainly have a negative impact on transfer traffic rather than local traffic (known as Origin&Destination), as it was partly offset by population that moved to Poland from Ukraine.

One of the main factors influencing the results of the new IATA forecast is the inclusion of environmental regulations that will take effect in the coming years, such as: ReFuelEU, ETD, EU ETS, and CORSIA –among others related to the EU package Fit For 55. Analyses have indicated that in the 2030s, environmental regulation could reduce demand by up to 8% relative to a non-regulated scenario, which is most relevant to short-haul European travel. However, analyses show that this factor will clearly lose importance in the long term due to technological advances and the falling price of sustainable aviation fuel (SAF).

In addition, IATA has performed detailed analyses of the transfer market and CPK’s competitive position against other hubs. In its analysis, IATA has taken into account the development of the market to date, including the changes after the COVID-19 pandemic and those related to the war in Ukraine, and forecasted changes in the future. The results of the transfer traffic analyses indicate a very high potential of CPK Airport for the development of transfer traffic in the axis: North America – Europe – Asia. In addition, the CPK Airport has favourable conditions for the development of transfer traffic within Europe.

IATA also analysed and taken into account other issues, including in particular CPK’s airport charges related to the business – investment model, as well as the competitiveness of aviation vs. High Speed Rail.

What are the results of the forecast?

The results of the 2023 IATA Strategic Scenario for CPK fall in the middle part of the 2021 forecast corridor – in the range between the high and low forecasts for the 2021 IATA assumptions. CPK is therefore prepared for such traffic development, as flexibility and modularity for different traffic scenarios was ensured from the planning phase onwards.

According to the latest forecast, CPK airport could reach 28 million passengers in 2030, 40 million passengers in 2040 and then in 2060 it should exceed 60 million passengers. By comparison: In 2021, the baseline forecast indicated 30 million passengers in 2030, 45 million in 2040 and 65 million in 2060.

Phasing is key to the success of CPK

Based on the results of the forecast and discussions with the strategic investor, an additional phase with a capacity of approx. 34 million passengers per year was introduced – with the possibility of quick expansion. The airport infrastructure will be adapted to handle hub traffic (assumed transfer traffic of around 40%). Capacity parameters for opening day were confirmed by the selected CPK strategic investor, the consortium of Vinci and IFM.

The new solution allows for a significant increase in capacity relative to Chopin Airport while reducing the scope and cost of construction for the opening day. At the same time, the analyses carried out as part of the business plan confirm the high profitability of the investment for the new forecast and phasing plan.

Due to the forecast corridor, i.e. the range between IATA’s 2021 low and high forecasts, and the experience related to COVID-19, the factor of infrastructure modularity and flexibility was introduced into the design process from the outset. The additional phasing to a capacity of 34 million passengers per year (with the possibility of rapid implementation of further expansion phases) is partly related to the phasing of the terminal and aircraft stands.

The first phase’s capacity of 34 million passengers per year fits in with examples of other greenfield airports, i.e. airports built ‘from scratch’ – without existing infrastructure. The initial capacity of Incheon Airport in Seoul was 30 million passengers. Today – after the launch of the next phases – it now sees 77 million passengers.

The new IATA 2023 Forecast for CPK confirms that the construction of two independent runways is necessary from the opening day as a solution to the capacity problems occurring at Chopin Airport.

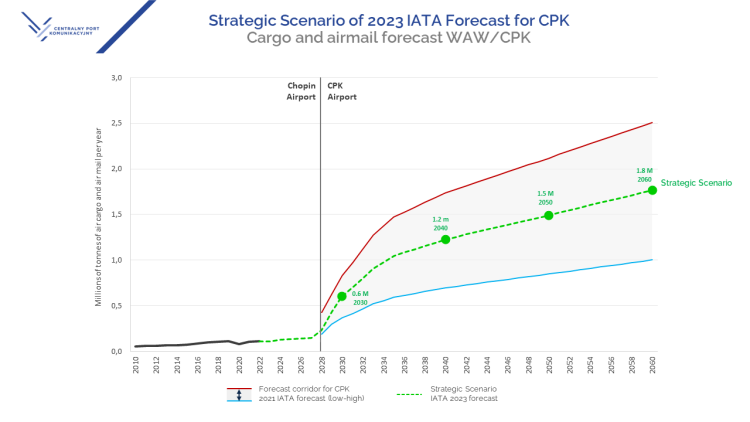

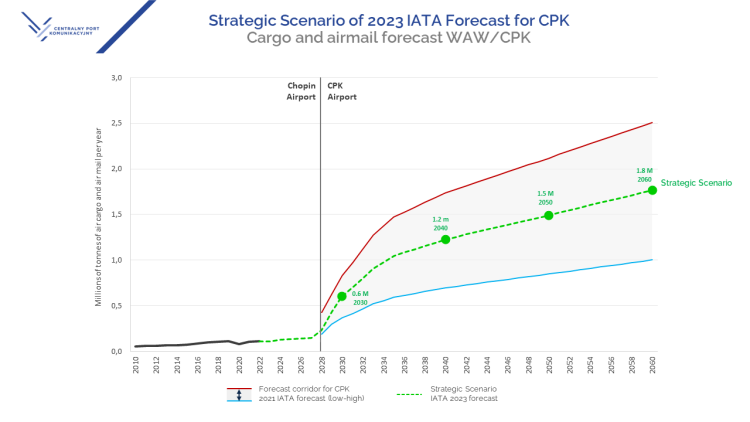

Air cargo forecast. Strong potential for market development

In Strategic Scenario 2023, air cargo and air mail projections are at a similar level to the IATA 2021 forecast. Due to the current limitations of Chopin Airport, the projections are primarily based on IATA’s analysis of the potential of the Central and Eastern European cargo market and the determination of CPK Airport’s achievable market share. These figures confirm that the construction of CPK is invariably necessary for Poland in view of the projected passenger and cargo traffic.

The IATA forecast is one of the many sources of information used in the dimensioning of airfreight handling infrastructure. The cargo infrastructure of the CPK airport was determined on the basis of business arrangements with market stakeholders (including ground handling agents, airlines, freight forwarders and courier companies). These findings were based on independent analyses and investor assumptions.

As with the passenger section, the construction of the CPK’s cargo infrastructure will be phased. The specific phases of expansion will be the responsibility of the individual stakeholders, involved in organising and handling airfreight. The total area safeguarded for the development of cargo infrastructure at the CPK airport is sufficient to secure the handling of forecasts until at least 2060.

Arthur D. Little Independent verification of the forecast

The IATA 2023 Strategic Forecast Scenario was positively validated by the Vendor Due Diligence (VDD) analysis performed by the independent firm, Arthur D. Little, for the process of securing a strategic investor for the CPK Airport.

The analysis verified the forecasting methodology, macroeconomic assumptions, local and transfer traffic forecasts, the impact of environmental regulations, the impact of airport charges, the impact of the war in Ukraine, peak hour traffic forecasts and LOT Polish Airlines’ strategic assumptions.

The forecast of transfer traffic was verified by Arthur D. Little in three ways:

- Analysis of the methodology and results of the IATA transfer traffic forecast

- Independent analysis of the competitive advantages of LOT and the CPK airport

- Independent evaluation by Arthur D. Little

As a whole, the IATA 2023 forecast has been assessed by Arthur D. Little as based on best market practices in air traffic forecasting and appropriate for use for investor needs.

Related topics

Related organisations

Centralny Port Komunikacyjny Sp. z o.o., Solidarity Transport Hub Poland