Airport traffic in 2020: An unprecedented crisis and uneven recovery

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 21 October 2021 | Janik Gagne | No comments yet

Janik Gagne, Director of Economic Analysis and Statistical Services at ACI World, gives his analysis on global passenger and cargo traffic and an insight into the recovery phase.

Air transport has been one of the industries hardest hit globally by the COVID-19 pandemic, which has resulted in a full-scale global transportation crisis. It was quickly evident that this crisis would be unlike any other, and it rapidly plunged the air transport industry into survival mode.

The economic, social, and health implications for the aviation sector are far-reaching and the COVID-19 pandemic will continue to affect aviation businesses, passengers, and airports for years to come. While reductions in passenger traffic have occurred because of past shocks (e.g. 9/11, SARS, and the Eyjafjallajökull eruption), the prolonged, near-complete shutdown of air traffic was unprecedented since the years of World War II, which devastated travel and tourism. Despite the positive signs and prospects for recovery which resulted from the start of the vaccination campaign at the end of 2020, COVID-19 remains an existential crisis for airports, airlines, and their commercial partners.

Global passenger traffic

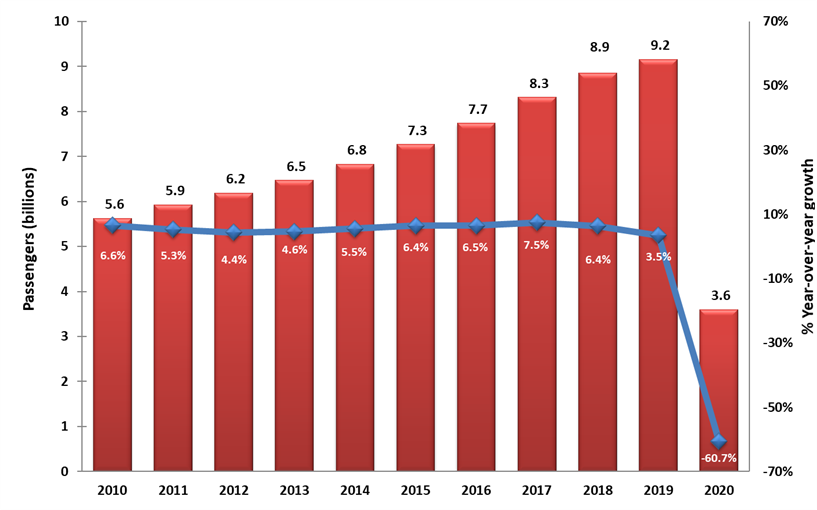

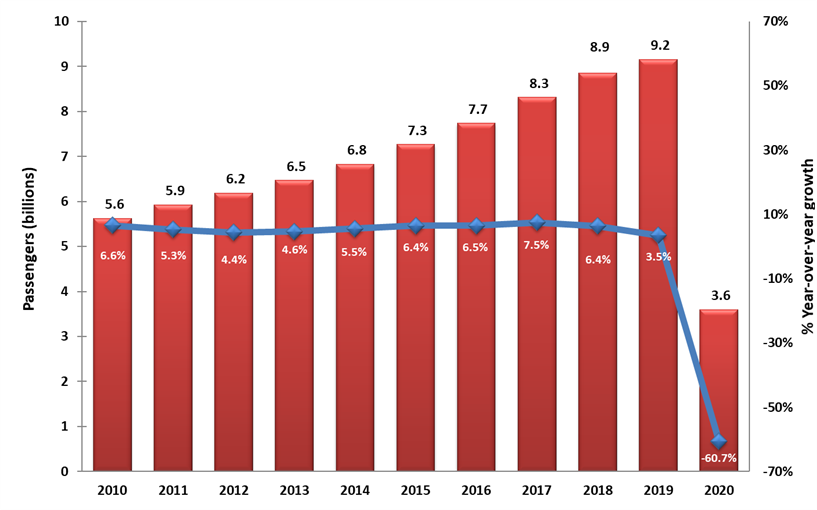

Not surprisingly, global passenger traffic recorded its biggest year-over-year decrease in recent history, plummeting 60.7 per cent from 2019 to a total of only 3.6 billion passengers (see figure 1).

After a decade of consistent and robust growth in global passenger traffic, the COVID-19 pandemic brought airports around the world virtually to a halt in the second quarter of 2020, erasing almost overnight more than 20 years of passenger traffic growth. As a result of travel restrictions and border closures, international passenger traffic fell significantly more than domestic passenger traffic (-75.7 per cent versus -52.2 per cent).

Prior to this, domestic passenger numbers accounted for more than half of all passenger traffic. Due to a surge of international tourism in recent years, however, the general trend was seeing international passenger traffic growing at higher rates than domestic passenger traffic. Following the ‘Great Lockdown’ of April 2020, international passenger traffic became virtually non-existent.

Air transport has been one of the industries hardest hit globally by the COVID-19 pandemic, which has resulted in a full-scale global transportation crisis. It was quickly evident that this crisis would be unlike any other, and it rapidly plunged the air transport industry into survival mode.

The economic, social, and health implications for the aviation sector are far-reaching and the COVID-19 pandemic will continue to affect aviation businesses, passengers, and airports for years to come. While reductions in passenger traffic have occurred because of past shocks (e.g. 9/11, SARS, and the Eyjafjallajökull eruption), the prolonged, near-complete shutdown of air traffic was unprecedented since the years of World War II, which devastated travel and tourism. Despite the positive signs and prospects for recovery which resulted from the start of the vaccination campaign at the end of 2020, COVID-19 remains an existential crisis for airports, airlines, and their commercial partners.

Regional passenger traffic

All regions suffered massive declines in passenger traffic in 2020. After being hit first, Asia-Pacific embarked on recovery earlier and faster than other regions, driven mainly by China’s domestic market. This helped the region to post the smallest percentage decline of all regions at -53.6 per cent compared to 2019. However, the fall was still very sizeable and in fact, Asia-Pacific recorded the largest loss of all regions in passenger numbers in 2020, seeing 1.8 billion fewer passengers compared to 2019. The region’s relatively good performance in percentage terms was mostly driven by the early recovery of China’s domestic market, which saw traffic levels similar to 2019, as early as September 2020, offsetting its virtually absent international passenger volume.

Fig. 1: Global passenger traffic (2010–2020). Source: ACI World Traffic Database, 2021

The story was repeated in the North America and Latin America-Caribbean regions. North America’s 61.3 per cent decline in passenger volume in 2020 compared to 2019 could have been worse had the region not been able to count on the United States’ domestic market. In Brazil (-55 per cent) and Mexico (-50.6 per cent), the domestic markets were key in making Latin America-Caribbean’s performance respectable compared to other regions.

On the other hand, because of their higher reliance on international passenger traffic, EU, the Middle East, and Africa were the regions impacted most in 2020, posting declines of 68.7 per cent, 66.7 per cent and 66.2 per cent respectively compared to 2019.

Global cargo traffic

Despite the general feeling that air cargo volume boomed in 2020, due to the requirements for personal protection equipment (PPE) and later for vaccine shipments, the decrease in passenger-aircraft movements which severely limited the availability of belly-cargo capacity, as well as the shutting down of global supply chains for many goods, offset gains from shipments of PPEs and online-retail merchandise.

Although some airlines converted some passenger aircraft into temporary freighters and dedicated-freighter usage increased, it was not enough to compensate for lost belly-cargo capacity. About 11.5 million metric tonnes less of air cargo were carried in 2020, returning the industry to 2015 to 2016 tonnage levels. Apart from North America, the only region to see increased air cargo traffic in 2020, all regions posted significant declines in air cargo volume due to the pandemic.

Air traffic demand in 2021

With the easing of local travel restrictions and the rollout of vaccinations worldwide, air travel is slowly showing signs of recovery.

Projections indicate that close to 19.7 billion passengers will traverse the world’s airports by 2040 – more than double the 2019 air passenger levels.”

In fact, ACI World’s latest data for June 2021 reveals that global passenger traffic increased by 13.2 per cent over the previous month, supporting the sentiment that many are eager to travel and to connect with others.

While there are yet many unknowns, such as how the new delta variant might see this trend flattened or temporarily reversed, airports are better equipped to deal with COVID-19-related obstacles on the long-term path to a sustained recovery.

Biography

Issue

Related topics

Air freight and cargo, Air traffic control/management (ATC/ATM), Airside operations, COVID-19, Passenger volumes, Tourism