China’s Aerotropolis: The Zhengzhou Airport Economy Zone

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 13 August 2018 | John D. Kasarda | No comments yet

With airports playing increasingly important roles as business magnets and metropolitan economic accelerators, John D. Kasarda, PhD, President of the Aerotropolis Institute China, describes this aerotropolis development process and how it is being applied in China to attract investment, boost trade, and increase passenger and cargo volumes.

The aerotropolis model, where airports are treated as key 21st-century drivers of business location and urban economic growth, is increasingly being incorporated into the competitive strategies of metropolitan regions around the world. The success stories of major existing aerotropolises such as those at and around Amsterdam Schiphol, Paris Charles de Gaulle, Dubai, Incheon, and Memphis airports have received considerable media attention. The model is likewise generating growing interest among airport operators and local governments in how to better leverage their airports to attract business investment, generate revenues, boost trade, and create well-paying jobs.

An aerotropolis is a metropolitan sub-region whose infrastructure, land use, and economy are centred on a major airport

Nowhere is this being played out more than in China, where over 100 airports and their surrounding areas are applying aerotropolis principles to foster these desired economic outcomes. An emerging national leader in applying the aerotropolis model is the 415 km² (160 mile²) Zhengzhou Airport Economy Zone (ZAEZ) which is being developed on and outward from Zhengzhou Xinzheng International Airport (CGO), 30 km (18 mile) southeast of downtown Zhengzhou and a little over an hour flight inland from Beijing or Shanghai.

The ZAEZ was formally established by China’s State Council in March 2013 as a national strategy to foster the global integration, economic transformation, and prosperity of China’s largest province (Henan, population of 96 million) and its capital city (Zhengzhou, population of 9.9 million). A specific charge of the State Council was to accomplish this by creating the first comprehensively planned, purposely built aerotropolis in China.

Development of the ZAEZ represents a collaborative effort of Henan Province, the Zhengzhou municipality, and the Civil Aviation Administration of China. Leadership and day-to-day management are handled by the Administrative Committee of the ZAEZ. The Committee has been systematically implementing the aerotropolis model to achieve the ambitious objectives set by the State Council. Economic performance and physical development have been so impressive to date that the ZAEZ is fast becoming known as “China’s Aerotropolis”.

The Aerotropolis Model

Simply put, an aerotropolis is a metropolitan sub-region whose infrastructure, land use, and economy are centred on a major airport. Its primary value proposition is that it offers its businesses speedy connectivity to their suppliers, customers, and enterprise partners nationally and worldwide. Many aerotropolis firms, especially those in the high-tech, biomedical, and advanced business service sectors, are time-sensitive and often more dependent on distant suppliers and customers than those located in their own metropolitan region (see www.aerotropolis.com). For such firms, time is not only cost, it is also currency, with the shortest connecting time between widely distant locations being a non-stop flight.

The aerotropolis also contains the full set of logistics and commercial facilities that support aviation-linked businesses, cargo, and the tens of millions of air travellers who pass through the airport annually. These facilities include, freight forwarding and supply chain management; bonded warehouses, high-value food perishables, e-commerce, and pharmaceutical distribution facilities; office buildings, hotels, and convention and exhibition complexes; and health and wellness, research, and education services, as well as leisure and tourism venues. Appropriately sited and publicly serviced residential areas house many of the employees of these airport-area businesses.

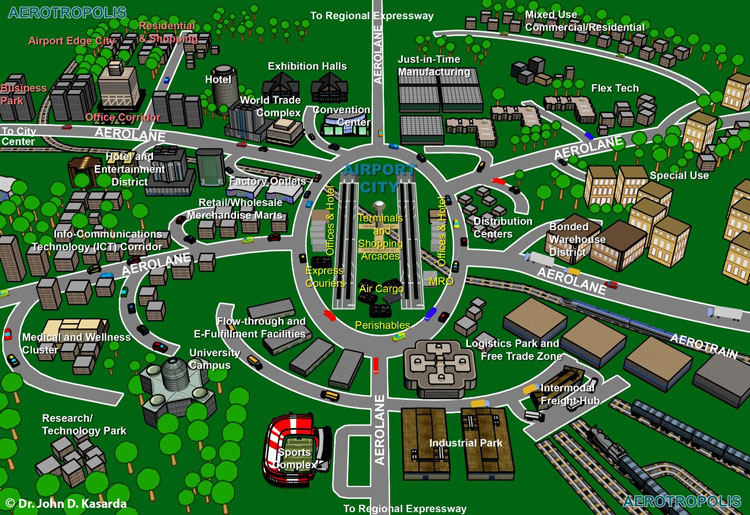

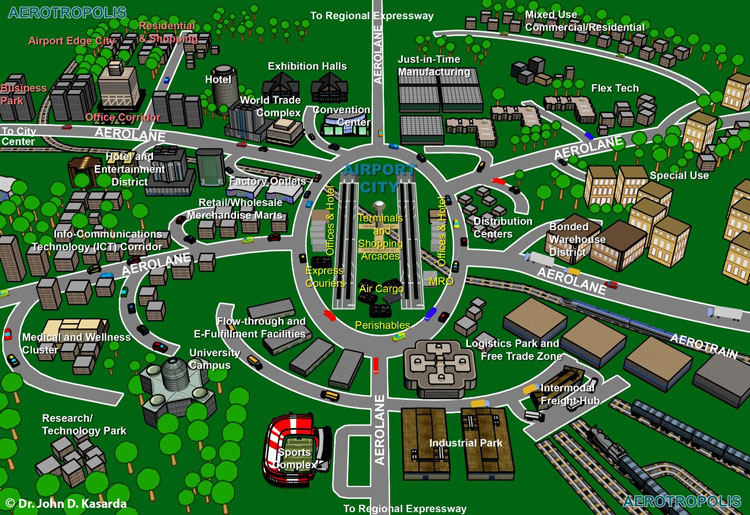

As an increasing number of aviation-oriented firms, their supporting service providers, and associated residential developments cluster around airports and outward along their highway and rail corridors, the aerotropolis emerges where air travellers and locals alike work, shop, meet, exchange knowledge, conduct business, eat, sleep, and are entertained, often without going more than fifteen minutes from the airport (see Exhibit 1). A new, dynamic urban growth pole forms, with multimodal transportation infrastructure (air, highway, rail, and links to ports) efficiently connecting aerotropolis businesses and people to markets near and far, accelerating trade in high-value goods and services and enhancing the aerotropolis’ local, regional, national, and global economic importance.

Exhibit 1: General aerotropolis schematic

Integrated Aerotropolis Planning

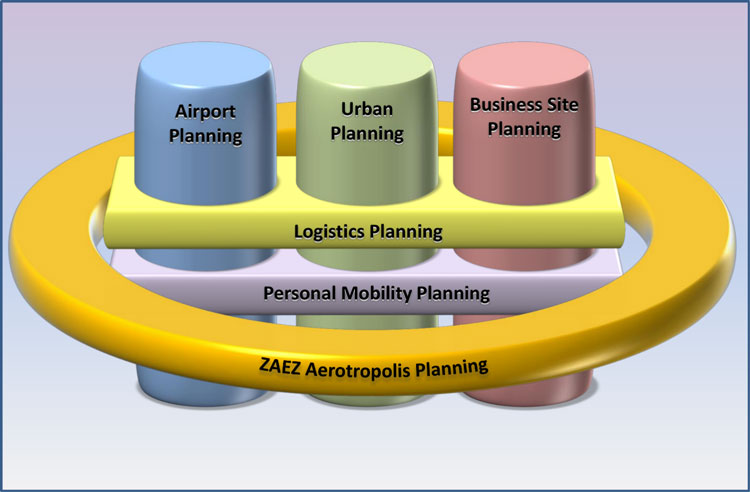

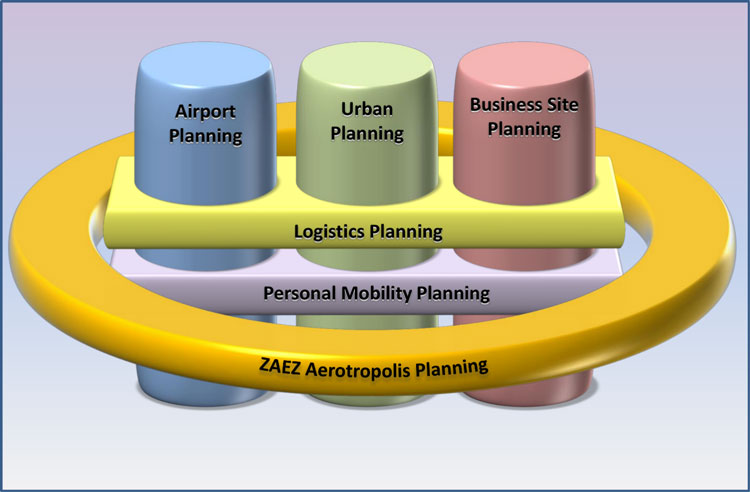

Integrated planning across three critical domains – business, transportation, and urban development – is essential for aerotropolis success. This is where the ZAEZ has excelled. The ZAEZ’s strategic planners brought together and successfully reconciled (1) the business site and profitability objectives of individual firms making capital investments; (2) airport and surface transportation planning objectives of ensuring maximum access to the airport and business sites at the lowest possible cost; and (3) urban planning objectives of livability and environmental sustainability. Closely collaborating with CGO’s management, they have also designed systems for efficient, secure cargo logistics and for speedy, safe movement of passengers to and through the airport while substantially expanding CGO’s national and international route network.

The ZAEZ was the first and most successful aerotropolis in China to address business, multimodal surface transportation, airport, and urban objectives as an integrated whole, leading to economically efficient, attractive, and sustainable development. By carefully following and, more importantly, implementing the golden ring of aerotropolis planning as shown in Exhibit 2, the ZAEZ also placed itself on a trajectory of remarkable investment attraction and trade facilitation. In becoming the modern aerotropolis precisely as envisioned by the State Council in 2013, the ZAEZ is catalyzing numerous sectors throughout the Zhengzhou metropolitan region and greater Henan Province. These range from aircraft leasing, cross-border e-commerce, perishables distribution, and tourism to aerospace component manufacturing, biomedicine, financial services, and smartphone assembly.

Exhibit 2: ZAEZ’s golden ring of aerotropolis integrated planning

Economic Performance

The achievements of the ZAEZ in terms of industrial investment, economic output, and trade volume have been remarkable. Between 2013 and 2017, 334 major projects were completed, with total fixed investment in 2017 alone reaching 68 billion RMB (10 billion USD). Value added by large-scale industries amounted to 30 billion RMB (4.3 billion USD) in 2017, with the Zone’s GDP exceeding 70 billion RMB (9 million USD) and growing at an annual compound rate of nearly 20 per cent since 2013. Combined imports and exports were 337 billion RMB (50 billion USD) in 2017, which ranked the ZAEZ first in trade among China’s bonded zones, constituting 65 per cent of the total value of Henan Province’s trade.

Contributing most to this economic growth and trade surge is Foxconn, the contract manufacturer for Apple’s iPhones. Approximately 250,000 workers at Foxconn’s immense ZAEZ factory complex produced 103 million iPhones in 2017 (see Exhibit 3), accounting for 50 per cent of all iPhones sold globally. By the end of 2017, a total of 60 smartphone manufacturers were in operation in the ZAEZ, who had produced a combined 299 million handsets. This accounted for one-seventh of all smartphones produced globally.

Exhibit 3: Foxconn assembly complex at the ZAEZ

The growth in the ZAEZ’s smartphone production has been complemented by substantial additions of firms in seven other modern industry clusters. During 2017, the aviation logistics industry cluster attracted 36 firms with total investment of 29 billion RMB (4.2 billion USD) with estimated annual revenue of over 50 billion RMB (7.5 billion USD). The e-commerce industry cluster drew 431 firms, of which 338 were registered as cross-border e-commerce firms, with another 12 whose facilities were still under construction.

By the end of 2017, more than 70 firms in the biomedicine cluster contracted to locate in the ZAEZ, 80 per cent of which will begin operation by 2019; estimated annual output value is anticipated to reach 10 billion RMB (1.5 billion USD). The precision machinery industry cluster attracted 14 firms with a total investment of 35 billion RMB (5.1 billion USD), with forecasted annual revenue reaching 80 billion RMB (11.6 billion USD) when these firms begin full operation. The electronic information industry cluster has drawn 221 firms with total investment amounting to 115 billion RMB (16.5 billion USD) and annual revenue expected to reach over 130 billion RMB (19.3 billion USD) at buildout. The aircraft manufacturing and maintenance industry cluster attracted five firms with a total investment of eight billion RMB (1.2 billion USD) and annual revenue which is forecasted to reach 10 billion RMB (1.5 billion USD) at full operation. By 2017, the modern trade and exhibition industry cluster had attracted 30 firms, which are anticipated to invest 60 billion RMB (8.7 billion USD) at buildout. Over 37 billion RMB (5.5 billion USD) in goods trade were completed in 2017 by those firms already operating in this cluster.

The ZAEZ’s near-term goals are highly ambitious, including attracting new investment in R&D and advanced business services. Its leaders anticipate that the annual GDP will be 79 billion RMB (11.5 billion USD) in 2018 based on a total fixed asset investment of 78 billion RMB (11.4 billion USD). Smartphone production will continue to be at the forefront, with the ZAEZ striving to assemble 400 million units annually by 2020 when a second Smartphone Business Park B is in full operation.

ZAEZ management is also currently recruiting firms in big data analysis, cloud computing, software engineering, auditing, insurance, and specialised international finance, such as aircraft leasing. Their goal is to have the total value of imports and exports of goods and services exceed 413.5 billion RMB (60 billion USD) in 2018, a 31 per cent increase over its 2016 trade total. Based on the ZAEZ’s remarkable record of accomplishments to date, this goal certainly appears achievable.

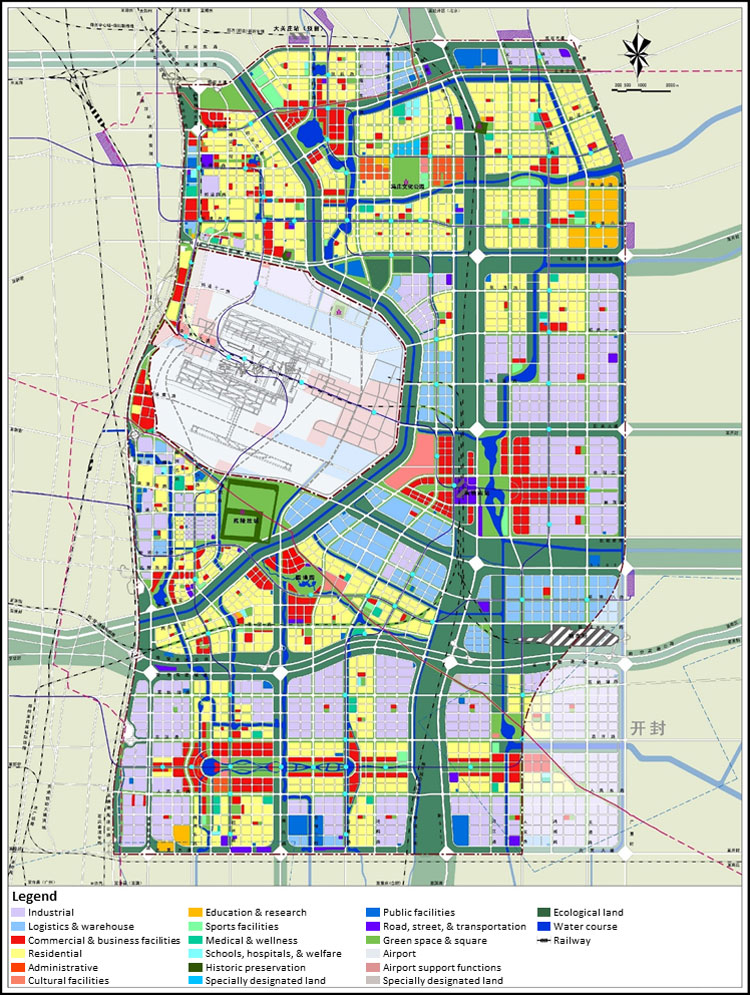

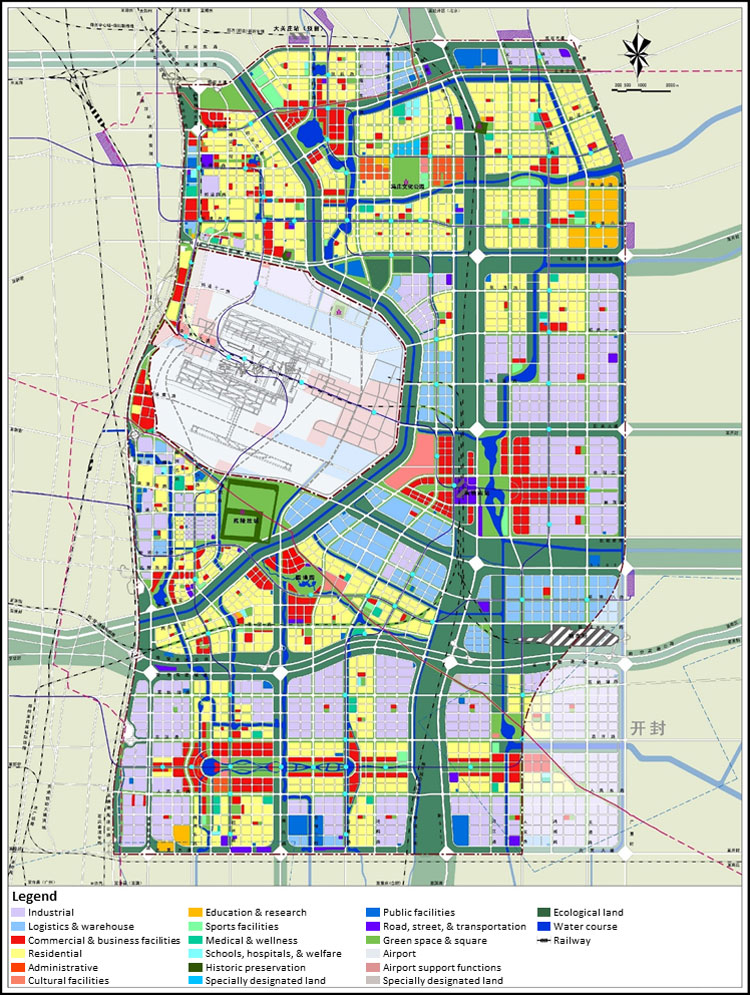

Aerotropolis Land Development

Exhibit 4 presents the ZAEZ’s land-use plan. Three broad aerotropolis districts constitute its development strategy. The vast majority of economic activity to date has been concentrated in an Airport District that consists of CGO property (48 km2 or 18.5 mi2) and its surrounding areas. The Airport District contains the ZAEZ’s 5.1 km² (2 mile²) bonded zone (the Zhengzhou Xinzheng Comprehensive Bonded Zone) where Foxconn and a substantial number of other time-sensitive manufacturing, logistics, and distribution firms are located. Enterprises in the zone focus mainly on bonded manufacturing, bonded warehousing and logistics, bonded maintenance, perishables, and cross-border e-commerce.

Exhibit 4: Zhengzhou Airport Economy Zone Land-Use Plan

Along with the massive Foxconn campus, completed structures in the bonded zone as of mid-2018 included a number of warehouses, logistics and air express facilities encompassing 230,000 m2 (2.5 million ft2), an inspection area of 18,600 m2 (200,200 ft2), parking, and a to-be-inspected area of 20,600 m2 (222,000 ft2). A range of functions supporting the ZAEZ’s existing bonded manufacturing functions – such as expanded Customs, inspection and maintenance, warehousing and logistics, cold storage, merchandise display, aircraft leasing, and trade services – were being constructed in 2018 with total investment amounting to around 1.3 billion RMB (190 million USD). The bonded zone is scheduled to be built out in 2021.

In addition to aviation-industry sectors, such as aircraft components production, the Airport District contains a cross-border e-commerce logistics centre, and a comprehensive perishable import-export complex which contains a meat port, live Australian cattle port, fruit port, fresh seafood port, and frozen seafood port. These ports have provided a major boost to Henan Province’s modern agricultural and food processing sectors. In addition, they serve to bring perishable food products from these sectors to Henan Province and greater Central China from around the world. For example, from 2014 to October 2017, 12,000 tonnes (13,200 tons) of fruit were imported through CGO, as were 7,400 tonnes (8,160 tons) of fresh seafood. In the first ten months of 2017, 3,300 tonnes (3,640 tons) of fruit were imported from North America to China via CGO, accounting for nearly 70 per cent of all fruit airfreighted from North America to China. In addition, CGO is one of China’s largest international postal transit ports, with 2,720 tonnes (3,000 tons) of post going through CGO from 2014 to October 2017.

For aviation equipment manufacturing, the Airport District has attracted German IAS Aircraft Interiors, Mooney Aircraft Manufacturing, and Sino-France General Aviation Aircraft Manufacturing. In terms of air logistics, DHL, Prologis, TNT-Sinotrans, UPS, FedEx, and SF-Express are among the 140 express carriers, freight forwarders, and 3PLs that operate in this district along with e-commerce firms such as Alibaba, Suning E-Commerce, and the Henan cross-border electronic business platform.

The cornerstone of the ZAEZ’s fast-growing e-commerce sector is the Airport District’s International E-commerce Industrial Park. Opened in November 2014, by buildout, the Park plans to invest 2.5 billion RMB (360 million USD), with constructed facilities of 460,000 m2 (5 million ft2), of which the first phase, already in operation, contains 160,000 m2 (1.7 million ft2). Its initial phase has 70 companies contracted, such as VIP and the Henan Civil Aviation Development and Investment Corporation.

As its name implies, the Park focuses primarily on cross-border e-commerce, supplemented by domestic e-commerce. By providing comprehensive and tailored services for large, medium, and small e-commerce enterprises, it offers a one-stop shop of international e-commerce support for Central China. Its functions bring together e-commerce operation centres with merchandise exhibition areas and logistics and distribution facilities.

In the eastern section of the airport district (about five km or three mi from the airport and just west of the new high-speed rail station), China’s Greenland Group (a Fortune 500 company) is partnering with Xing Gang Investment, a wholly owned company under the ZAEZ’s management committee, to construct an expansive, 10-billion-RMB (1.5-billion-USD) convention, trade, and exhibition complex. Known as the Zhengzhou New International Convention and Exhibition Centre (ZNICEC), this complex will house 34 exhibition halls, spanning 148 hectares (366 acres). Total space of constructed buildings will exceed one million m2 (10.8 million ft2), with exhibition facilities alone encompassing 400,000 m2 (4.3 million ft2), one of the largest in the world. In mid-2018, the first phase of construction, covering 65 hectares (161 acres), was well on its way to completion, with a main landing hall, 16 exhibition halls, two service halls, a four-star hotel, a warehouse, and energy centre being built with a total investment of 4.5 billion RMB (650 million USD). Phase 1 is scheduled for operation in 2019.

Place making and environmental sustainability characterise ZNICEC building design and construction. The design reflects the history and culture of China’s Central Plains, with symbols of these incorporated in the complex’s architecture and landscape. To advance environmentally sustainable operations, the exhibition centre employs green building principles such as mixed ventilation, LED lighting, water-saving technologies, intelligent building operations, regional energy stations, and other conservation methods.

When completed in the early 2020s, it is anticipated that the ZNICEC will anchor substantially more commercial development over the following decade, augmented by a combination of nearby air, high-speed rail, intercity rail, metro subways, and modern highways. This multimodal transportation infrastructure is expected to attract complementary businesses such as hotels, retail, restaurants, and entertainment facilities along with exhibition-supporting sectors such as ICT, catering, printing, advertising, design, and translation services.

A future urban centre is being planned to be located immediately east of the high-speed rail station not far from the exhibition complex. This area is targeted for enterprise headquarters and other corporate functions; financial services, including the Central Plains Stock Exchange; producer services, such as auditing, consulting, marketing, and online business platforms; and support functions, such as shopping, dining, health and wellness, entertainment, and executive-class condominiums. With the ZNICEC and its associated businesses on one side of the high-speed rail station and the enterprise and commercial services area on the other side, a major exhibition industry ecosystem and new urban business district will be formed. Both will be driven by the “double-port engine” of the high-speed rail station and the nearby airport along with its connecting surface transportation infrastructure.

South of the Airport District is the High-End Manufacturing District primarily geared toward precision and advanced manufacturing, biomedicine, IT and ICT equipment, R&D, and production of new aerospace equipment materials such as carbon-fiber composites, polymers, and ceramics. Taiwan’s Fair Friend Group is opening one of the world’s largest precision machine tool manufacturing bases there in 2018, featuring 3D printing, robotics, and laser technologies. The group is investing 3.5 billion RMB (510 million USD) in the ZAEZ to manufacture 22 machine tool brands, which will be sold globally.

The Zhengzhou Biomedicine Park is also located in the ZAEZ high-end manufacturing area. This Park will be the largest R&D and production base for medical science in Henan Province. Its plans cover 130 hectares (330 acres) at buildout with the first phase covering 25 hectares (60 acres). In 2017, the incubation base and pilot test platform commenced construction, encompassing 400,000 m2 (4.3 million ft2) with 2 billion RMB (360 million USD) invested, including a lab test centre, pilot test centre, production plant, bio-logistics system, exhibition centre, and living facilities. That same year the Biomedicine Park Exhibition Centre was opened.

By introducing leading biomedical products, allocating resources for product innovation, building technical services and bio-logistics platforms, and attracting upstream suppliers and downstream distributors, the Park seeks to generate one of the world’s most integrated biomedicine clusters. This end-to-end cluster will include R&D and provide comprehensive services for the large-scale production and distribution of biomedical products. To accomplish this objective, the Park plans to invest 500 million RMB (73 million USD) in constructing five technical service platforms – a biomedical R&D platform; new animal drug platform; small-molecule chemistry, manufacturing, and controls preparation R&D platform; macromolecule pilot test service platform; and cell technology service platform – which will provide integrated innovation and research support for biomedical enterprises. At the same time, a biomedicine research institute will be established to focus on fast-growing, high-value product sectors, such as protein-based biologics. To further support innovation and entrepreneurship, the park is endeavoring to build professional incubation platforms for companies that could provide comprehensive services like enterprise registration, preferential policies implementation, financing, skills training, talent recruitment, patent declaration, and intellectual property protection.

By mid-2018, more than 70 biomedicine enterprises signed cooperative agreements with the Park, covering areas such as drug chemistry, cell therapy, diagnostic reagents, and pharmaceutical distribution. Its goal over the next ten years is to develop or attract at least 300 biomedicine enterprises that will generate up to 100 billion RMB (14.5 billion USD) in economic output, evolving into the leading bioscience and biomedicine base for Central China and an internationally significant biotechnology innovation node.

The ZAEZ catapulted into global prominence when Foxconn located the largest iPhone assembly campus there. Its smartphone production base has continued to rapidly expand, with, as noted, 59 other smartphone enterprises joining Foxconn in the aerotropolis. Almost all of these firms located in a new Smartphone Business Park located in the high-end manufacturing district. This Park, which officially opened in January 2014, covers 25 hectares (60 acres). In addition to smartphone assembly, the Park includes enterprise headquarters, R&D, software development, product design, and marketing functions. Companies such as AMER, ZTE, and Coolpad are operating in the Park. Together, they produced 196 million handsets in 2017, nearly doubling Foxconn in total smartphone production, which also has some of its operations in the Smartphone Park. These firms occupy 610,000 m2 (6.6 million ft2) of facilities, which were developed between 2014 and 2016. Commercial real estate absorption at the Smartphone Business Park has been so rapid that an additional park commenced construction in early 2017 – Smartphone Business Park B. Park B covers 30 hectares (70 acres) and will offer constructed facility space of 548,000 m2 (5.9 million ft2). When completed, total facility investment is expected to reach 2.5 billion RMB (360 million USD).

Not far from the Smartphone Business Park is the Garden Expo Area. A 398-hectare (983-acre) Garden Exhibition site hosted the 11th China (Zhengzhou) International Garden Expo between September 2017 and May 2018, which constituted the largest and highest-level fair in China’s gardening and flower domain, attracting tourists from around the world. The total Garden Expo Area, which remains open to tourists and visitors, contains three sites – Garden Exhibition Park (Site A), Shuanghe Lake Central Park (Site B), and Yuanling Old Town Ruins Park (Site C).

The key objectives of the International Garden Expo are to display horticultural products from nations around the world while promoting green development and the culture and history of the Central Plains as the cradle of Chinese civilisation. Its structure consists of two sites with two cores. The two sites refer to the Garden Exhibition Park and the Yuanling Old Town Ruins Park, which connect antiquity with modernity, symbolising the developmental history and culture of China’s Central Plains. The two cores are the Chinese Civilisation Garden inside the Garden Exhibition Park and the Inner Town Ruins Park inside Yuanling Old Town, which are the main culturally themed gardens of each park, respectively.

A man-made lake in the southern Garden Exhibition Park with a mountain to its north forms the main axis of the Park’s landscape. Along this axis, there are strings of cultural architecture highlighted by the main entrance, Huasheng Pavilion, the main exhibition hall, and Xuanyuan Pavilion.

Also located in the broader Garden Expo Area is Shuanghe Lake Central Park, around which the Shuanghe High-End Business Services Area is being developed, applying an ecological theme. A 1.5 km² (0.58 mile²) lake is the centre-piece of this business services area. This district, which covers 6 km2 (2.3 mi2) and possesses constructed building space of six million m2 (65 million ft2), will serve as a new CBD (central business district) targeted to attracting corporate offices and advanced business services firms, such as auditing, legal services, and marketing, in addition to cloud computing firms. An underground and under-the-lake network of roadways and utility tunnels as well as parking facilities and a commercial complex were completed in 2017. As of 2018, projects and enterprises located in the Shuanghe High-End Business Service area included the Alibaba Cloud Computing Base, the Greenland Group office complex, Taishang Software Park, ZENSUN, and the Zhengzhou World Trade Centre. High-quality executive housing is being developed near the new CBD as well.

In a similar manner, an Urban Services District, located north of the Airport District, is targeted for (1) international financial services such as aircraft leasing; (2) scientific and knowledge-intensive functions such as software engineering; (3) cultural and leisure facilities; and (4) mixed-use commercial/residential areas with urban amenities for executives, professionals, and knowledge-workers, including an international K-12 academy that opened in fall of 2015 with a university-like campus, English-language teachers, and Western curricula based on Silicon Valley schools. Other international schools are being developed throughout the ZAEZ’s three broad districts (with a consulate area and a higher education and innovation complex under planning) along with eight major airport-oriented industrial parks (aviation logistics, aviation manufacturing and maintenance, biomedicine, electronic commerce, electronic information and cloud computing, precision machinery, smartphones, and trade and exhibition). Numerous projects, some with investment exceeding 6.5 billion RMB (1 billion USD), are completed or under construction in these industrial parks, which contain the likes of Alibaba, K-touch, Fair Friend Group, and ZTE. Well-designed residential areas and mixed-use commercial/residential areas are being developed throughout the ZAEZ as well, with housing ranging from affordable apartment complexes to high-end, detached executive units.

All ZAEZ construction projects operate under environmental protection and sustainability initiatives. In early 2016, over 10 million m2 (107.6 million ft2) of green landscaping (horticulture, trees, grassland, etc.) commenced development, of which 3 million m2 (32.3 million ft2) were completed by the end of the year at a cost of 5.5 billion RMB (800 million USD). In 2017, 8.1 million m2 (87.2 million ft2) of green landscaping were added along with a further 1.5 million m2 (16.1 million ft2) in 2018. Particular efforts are also being directed at improving air quality, which has emerged as a major problem throughout much of Central China. The ZAEZ’s 220 construction sites that were active in 2018 were all functioning in line with government-designated environmental standards.

In 2016, the State Council encouraged Zhengzhou (including the ZAEZ) to become one of eight national central cities. National central cities are defined as leading cities in China featuring: a) national economic development and resources allocation; b) national integrated transportation and information network hubs; c) national education, culture, and innovation centres; and d) national logistics and comprehensive urban business services centres. Led by the ZAEZ, Zhengzhou’s strategy will be to develop new knowledge and technology-intensive industries as well as foster entrepreneurship and innovation platforms that will bring multiple tiers of talent to new knowledge-based industries emerging in the ZAEZ and throughout the Zhengzhou metropolitan region.

The Aerotropolis Engine: CGO

Powering the aerotropolis is Zhengzhou Xinzheng International Airport (CGO), designated as one of eight national Category 1 airports in China. CGO serves as the Asia hub for Cargolux Airlines as well as a focus airport for China Southern. CGO’s strategic location at the geographic centre of China’s population provides airlines with the shortest average flight times to major domestic markets, three-fifths of which can be reached in less than 90 minutes, while 90 per cent of the Chinese population can be reached within 150 minutes. In May 2017, Air Asia China announced plans to make CGO its future hub.

Fifty-four airlines (42 domestic and 12 international) were operating at CGO in mid-2018, which provided 201 air routes (28 international air routes) connecting 109 cities domestically and internationally. CGO’s air route network covers major cities across China, Northeast Asia, and Southeast Asia, as well as Dubai and Vancouver. The airport plans to add at least three new intercontinental passenger routes directly connecting it to Europe, America, and Oceania. 21 cargo airlines (including 14 international airlines) also operate at CGO. The number of all-cargo air routes (34 all-cargo air routes, 29 of which are international) ranks first in inland China. These routes link CGO to fifteen of the top twenty global cargo airports.

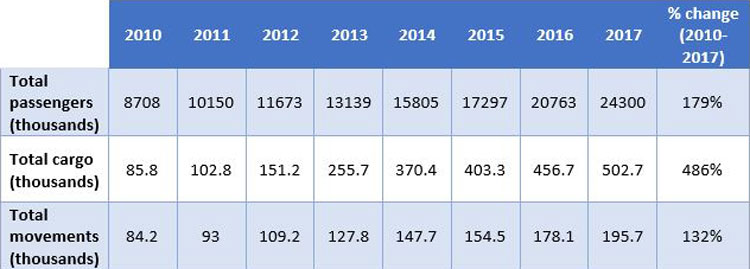

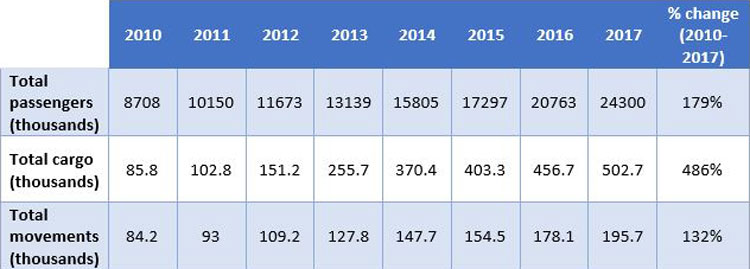

Both air cargo and passenger growth at CGO have been phenomenal. Between 2010 and 2017, freight volumes experienced an annual compound growth rate of 27 per cent, soaring from 85,800 metric tonnes (94,600 tons) to 503,000 metric tonnes (554,500 tons). During the same period, annual passenger traffic expanded from 8.7 million to 24.3 million, a 15.8 per cent annual compound growth rate. CGO has been China’s fastest-growing cargo airport percentage-wise every year between 2013 and 2017 and was the nation’s fastest-growing passenger airport (by per cent growth) in 2014 and 2016 (see Exhibit 5). CGO ranked first in passenger and cargo volume in Central China in 2017.

Exhibit 5: Passenger, cargo, and aircraft movements at Zhengzhou Xinzheng International Airport (2010-2016)

The rapid rise of CGO’s cargo and passenger volumes stimulated a 19.1-billion-RMB (2.8-billion-USD) airport infrastructure and facilities expansion program that began in December 2012 and was completed in 2016. This includes a new 484,500 m² (5.2-million ft²) terminal (Terminal 2) that was put into operation in December 2015, with 79 passenger aircraft parking bays (71 contact gates and eight remote stands) and nine exclusive freighter bays. These additions bring CGO’s annual passenger capacity to 40 million and cargo capacity to 700,000 tonnes (770,000 tons). For international cargo, CGO offers bonded areas and an electronic customs clearance system with single-window declaration along with express inspection for import-export clearance. Modern immigration counters utilising the latest technology speed international passenger movements through the terminal.

Another major CGO infrastructure upgrade involves the addition of a 274,000 m² (3 million ft²) multimodal ground transportation centre (GTC) integrated with Terminal 2. Opened in 2015, the GTC has transit and parking areas for buses and taxis and underground halls for subways and intercity trains converging on CGO. As noted, a high-speed rail station (Zhengzhou South) is being built just east of the airport. Planned for completion in 2019, this seventeen-platform station will rank amongst China’s largest and will significantly extend the airport’s catchment area while catalysing commercial development around it described previously.

The long-term airport master plan (through 2045) shows CGO with five runways (one of which will be dedicated to air cargo), four passenger terminals, one satellite hall, three cargo areas, and additional cargo facilities, which will significantly upgrade passenger and cargo processing capacity. By 2030, CGO is forecast to reach 70 million passengers and 3 million tonnes (3.3 million tons) of cargo. Longer-term projections forecast an upwards trajectory of 100 million passengers annually and 5 million tonnes (5.5 million tons) of cargo.

When the new 484,000 m² (5.2-million ft²) Terminal 2 was opened in late 2015, the existing 128,000 m² (1.4-million ft²) Terminal 1 was closed to aviation and was repurposed for airport city functions. The older terminal (which will include some aircraft contact gates in the future) is being transformed largely into an integrated exhibition, trade, retail, and entertainment complex, the first of its kind in China. A four-star hotel with approximately 45,000 m2 (484,000 ft2) of constructed space is planned between Terminal 1 and Terminal 2.

Multimodal Surface Transportation

Efficient multimodal surface transportation has been as important as air routes for the ZAEZ’s, Zhengzhou’s, and Henan’s development. Zhengzhou sits at the crossroads of China’s national highway and rail infrastructure. The ZAEZ itself provides a seamless interface of aviation with major highways, intercity railways, high-speed railways, and subways.

National and major provincial roads serving the ZAEZ have been upgraded and expanded, forming a network of five vertical and six horizontal trunk roads. The trunk roads are being crosshatched with numerous high-quality secondary roads, providing a system of highways that efficiently links the ZAEZ to all of Henan Province and well beyond. Nearly 30 per cent of China’s GDP lies within 500 km (310 mi) of the ZAEZ.

The ZAEZ contains over 400 km (250 mi) of new roads (including 34 cross-river bridges) that have been constructed to efficiently link all sections to each other and to the airport. Subway lines with appropriately placed stations are located throughout the ZAEZ.

For external connectivity, Zhengzhou also possesses the fastest, deepest, and broadest rail systems complementing its highway systems. The city and ZAEZ are at the intersections of both the national freight rail systems and China’s north-south and east-west high-speed passenger rail systems. One of the largest high-speed rail stations in China is in downtown Zhengzhou (known as Zhengzhou East), with the aforementioned, new high-speed rail station (Zhengzhou South) nearing completion just east of the airport. The airport’s intercity rail station that directly connects to CGO’s new passenger terminal as well as the nearby South high-speed rail station are both being viewed not only for rapid passenger surface transport, but also for small package express delivery and for e-commerce distribution, the latter in which China leads the world.

Given its strategic location and superior multimodal surface and air connectivity, the ZAEZ is being positioned by China’s Central government as an interior lynchpin in its “Belt and Road” initiative based on the original Silk Road through Central Asia and the Middle East to Europe. Reinforcing the ZAEZ’s air cargo routes to the Middle East and Europe are the Zhengzhou-Europe block container trains, which operate regularly from Zhengzhou to Berlin, Hamburg, and Rotterdam via Central Asia, the Middle East, and Eastern Europe.

In 2017, China’s President Xi Jinping articulated the Central government’s strong support for the concept of the ‘Air Silk Road’. This concept is about increasing connectivity and trade in high-value, time-sensitive products and business services via expanding aviation routes. In particular, President Xi expressed his desire to see a Luxembourg-Zhengzhou Air Silk Road expand. The ZAEZ and Luxembourg are already well connected through Luxembourg’s national air cargo carrier, Cargolux, whose Asia hub is CGO. In 2017, over 147,000 tonnes (162,000 tons) of smartphones, electronics, and other high-value products were flown by Cargolux between Zhengzhou and Luxembourg. Plans are to substantially increase these cargo flows in 2018 and afterwards through a new joint-venture airline (Henan Cargo Airlines) being established by Cargolux and the Henan Civil Aviation Development & Investment Company. Air silk roads – complementing trade outreach via highway, railway, and port infrastructure development – will play an increasingly important role in boosting local and regional economies throughout China and be particularly instrumental to the ZAEZ in sustaining its impressive aerotropolis development.

Key Challenges Ahead

What about the ZAEZ’s future? Can its rapid development trajectory be maintained, especially now that the ZAEZ’s firm recruitment strategy is to move up the value creation chain by attracting innovation-driven industries and knowledge-based business services? Futhermore, what challenges or obstacles must be overcome for this next-generation firm recruitment strategy to succeed?

Given investment agreements already in place, it seems highly likely that the ZAEZ’s impressive growth will continue for at least the next three to five years, transforming it into a world-class aerotropolis. This transformation will further move the ZAEZ, Zhengzhou, and Henan Province up the industrial value chain in such sectors as biomedicine, cross-border e-commerce, food processing and distribution, high-end manufacturing, and knowledge-based business services. In so doing, the ZAEZ will become Central China’s centre for meat, seafood, fruit and vegetable distribution, biosciences, robotics and precision machine tools, smart electronics, and other innovation-driven industrial sectors, as well as in specialised business services.

These innovation-driven and knowledge-based sectors have substantial skill and talent needs, however, which the ZAEZ will have to work hard to meet through indigenous labour force upgrading and external talent recruitment. In addition to skills upgrading through education system reforms and talent recruitment, innovation-driven industrial development will require recruitment of branches, programs, and laboratories of leading international universities similar to that done by Dubai and Singapore in accelerating their modern knowledge-based businesses and industries.

Attracting and retaining well-educated knowledge workers, including management talent, will depend in large part on the ZAEZ upgrading its living, institutional, commercial, and social environments. In particular, the Zone must create dynamic urban subcentres with the full range of amenities desired by younger, highly educated Chinese professionals and foreign talent. For the ZAEZ, this would not only include more executive housing, more health and wellness facilities, and more English-language international schools, but also the establishment of five-star Western-managed hotels, fashionable shopping, trendy dining, modern leisure and entertainment venues, and areas with vibrant nightlife.

In short, the ZAEZ will need to develop the urban amenities, social vibrancy, and bright light effects found in major cities. These have proven instrumental in attracting younger, well-educated talent to Tier-One urban centres in China and elsewhere around the world, by making them locations where talented people want to live, work, and be entertained.

Creating urban ambience in the ZAEZ, of course, will take time, since it involves so much more than building roadways, factories, and office buildings. Yet, this must be done – and done relatively soon – if talent needs for its envisioned innovation-driven industries and knowledge-based business services sectors are to be met.

Zhengzhou Airport will also have to substantially expand its international air passenger routes, since knowledge workers are among the most intense global business air travellers. International financial institutions, regional corporate headquarters, and centres of innovation likewise typically require non-stop international air connectivity for their executives and professionals. The ZAEZ is very well served by fourteen international cargo airlines, linking it to the majority of the largest global cargo markets. Similar progress needs to be made in developing international passenger service, making the ZAEZ a key node in China’s Air Silk Road for importing talent and exporting high-value business services.

Is the ZAEZ up to meeting these challenges as it strives as much for quality as for volume of business development? Working with the Zone’s leadership for the past six years leads me to believe that, with the continuing political and financial support from Henan Province and Beijing, the ZAEZ will meet these challenges, thereby solidifying its reputation throughout the world as China’s Aerotropolis.

Biography

John D. Kasarda is the leading developer of the aerotropolis concept. He is President of the Aerotropolis Institute China, Director of the Center for Air Commerce at the University of North Carolina’s Kenan-Flagler Business School, and President and CEO of Aerotropolis Business Concepts LLC. He also serves as the editor-in-chief of Logistics, an international scholarly journal.

Dr. Kasarda has published more than 100 articles and 10 books on aviation infrastructure, logistics, and urban development and is frequently quoted in international media.

Dr. Kasarda has offered numerous workshops on aerotropolis development, logistics infrastructure, and global supply-chain management to airports, governments and multinational firms, many of which he has advised. He obtained his B.S. and M.B.A. (with Distinction) from Cornell University and his Ph.D. from the University of North Carolina at Chapel Hill. The recipient of many grants and awards, Dr. Kasarda has been elected a Fellow of the American Association for the Advancement of Science for his research on airport-driven economic development and is a former Senior Fellow and Trustee of the Urban Land Institute.

Dr. Kasarda may be contacted at [email protected].

Related topics

Aeronautical revenue, Airport cities, Airport development, Retail