Argentinian growth leads South American markets

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 6 June 2017 | CiR, International Airport Review | No comments yet

Detailed research undertaken by travel retail analyst, research and category expert, Counter Intelligence Retail indicates that Argentinians may offer the brightest hope for duty free and travel retailers in the region.

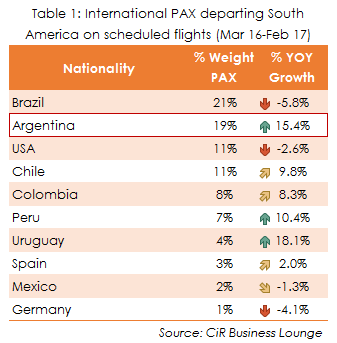

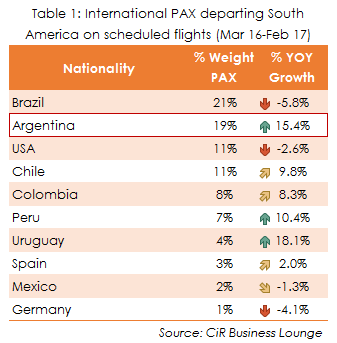

When it comes to international passengers departing from South America, CiR analysis shows that Argentinians outpaced most other key travel nations in the region in the 12-month period from March 2016 to February 2017.

Argentinians – who represent the second largest outbound market in the region after Brazilians – soared by +15.4%, while Brazilian’s themselves slid -5.8% (see Table 1). The nationality was the only faller among fellow South American markets according to data from CiR Business Lounge.

Double-digit bounces

Other markets in South America that had double-digit growth were Peru (+10.4%) and Uruguay (+18.1%) though these were off much smaller base rates.

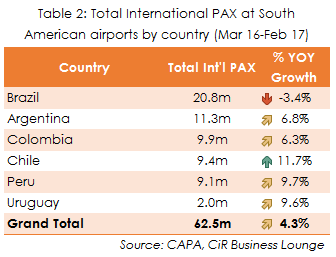

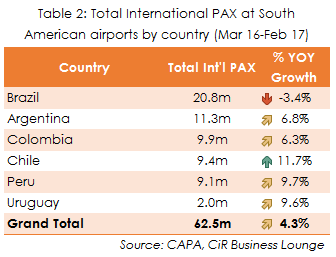

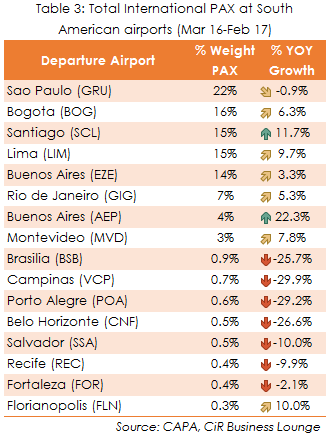

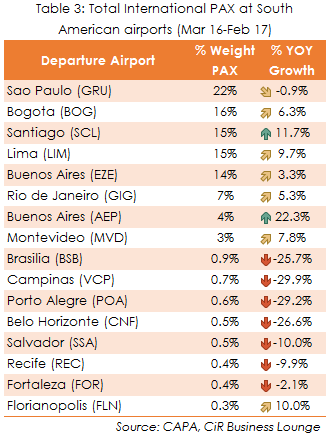

Garry Stasiulevicuis, President of Counter Intelligence Retail, says: “The top six country markets in South America have shown a welcome bounce with total international growth at their respective airports of +4.3% in the 12 months to February 2017 (see Table 2). Taking Brazilian airports out of the picture, that growth was much stronger at +8.5%.

“The Argentinian outbound surge represents among the best opportunities in the region for DF&TR operators to capitalise on this positive trend. But it’s worth noting that among the bigger airports in Argentina it is Buenos Aires Jorge Newbery Airport (AEP) that is showing the biggest overall international growth (+22.3%) while the country’s main gateway Buenos Aires (EZE) Ezeiza had a more modest +3.3% rise (see Table 3). UNWTO tourism spending statistics also indicate double-digit growth from Argentinians.” “The Argentinian outbound surge represents among the best opportunities in the region for DF&TR operators to capitalise on this positive trend. But it’s worth noting that among the bigger airports in Argentina it is Buenos Aires Jorge Newbery Airport (AEP) that is showing the biggest overall international growth (+22.3%) while the country’s main gateway Buenos Aires (EZE) Ezeiza had a more modest +3.3% rise (see Table 3). UNWTO tourism spending statistics also indicate double-digit growth from Argentinians.”

Is Brazil on the turn?

Brazil – due to its sheer size – has dragged down the international growth trend in South America, but there are signs that an improving economy may turn things around.

CiR Business Lounge data for total international PAX show that among the region’s top airports (with over 3% share of South American international PAX), only Sao Paulo (GRU) – which also happens to be the biggest airport in the region – saw a fall at -0.9%. Others such as Santiago (SCL) in Chile and Lima (LIM) in Peru were strongly up at +11.7% and +9.7% respectively.

“Slightly worrying is the slew of smaller international airports,” says Stasiulevicuis.

“Apart from Florianopolis (FLN) which saw a healthy +10% surge, the others – which are all Brazilian –were down by between -9.9% and -29.9%.

“On the plus side the key gateways of Sao Paulo (GRU) and Rio (GIG), which account for over 85% of Brazil’s international departures, now have more stable traffic flows. Meanwhile, Brazil’s government expects the country to return to economic growth this year which should help lift outbound PAX numbers. Consensus forecasts are also tipping Brazil’s GDP into positive territory – but only just at +0.8%”

Related topics

Related airports

Buenos Aires Jorge Newbery Airport (AEP), São Paulo Guarulhos International Airport (GRU)