Air cargo growth continues in January 2022 albeit at a slower pace

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 9 March 2022 | International Airport Review | No comments yet

Latest International Air Transport Association data highlights that the global air cargo markets experienced a slower growth in January 2022 due to supply chain disruptions and capacity constraints.

The International Air Transport Association (IATA) released data for global air cargo markets showing slower growth in January 2022. Supply chain disruptions and capacity constraints, as well as a deterioration in economic conditions for the sector dampened demand.

Note: We are returning to year-on-year traffic comparisons, instead of comparisons with the 2019 period, unless otherwise noted. Cargo demand is tracking above pre-COVID-19 levels, although capacity is still constrained.

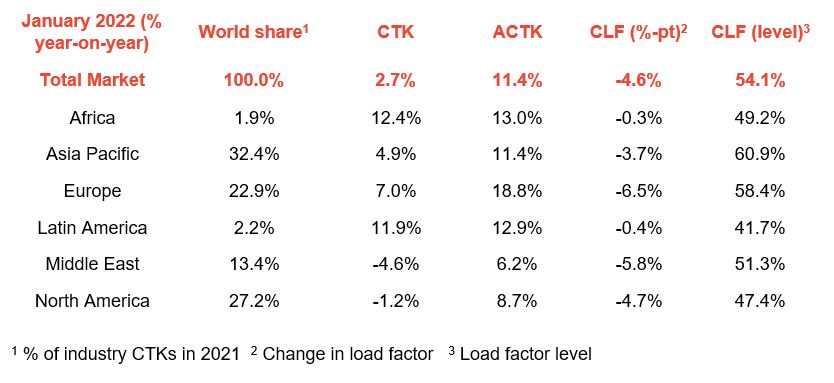

- Global demand, measured in cargo tonne-kilometers (CTKs), was up 2.7 per cent compared to January 2021 (3.2 per cent for international operations). This was significantly lower than the 9.3 per cent growth seen in December 2021 (11.1 per cent for international operations)

- Capacity was 11.4 per cent above January 2021 (10.8 per cent for international operations). While this is in positive territory, compared to pre-COVID-19 levels, capacity remains constrained, 8.9 per cent below January 2019 levels

- Supply chain disruptions, as well as a deterioration in economic conditions for the sector are slowing growth. Several factors should be noted:

- Supply chain disruptions resulted from flight cancellations due to labor shortages, winter weather and to a lesser extent the deployment of 5G in the U.S., as well as the zero-COVID policy in mainland China and Hong Kong

- The Purchasing Managers’ Index (PMI) indicator tracking global new export orders fell below the 50-mark in January for the first time since August 2020, indicating that a majority of surveyed businesses reported a fall in new export orders

- The January global Supplier Delivery Time Purchasing Managers Index (PMI) was at 37.8. While values below 50 are normally favourable for air cargo, in current conditions it points to delivery times lengthening because of supply bottlenecks

- The inventory-to-sales ratio remains low. This is positive for air cargo as it means manufacturers may turn to air cargo to rapidly meet demand.

Willie Walsh, IATA’s Director General commented: “Demand growth of 2.7 per cent in January 2022 was below expectation, following the 9.3 per cent recorded in December 2021. This likely reflects a shift towards the more normal growth rate of 4.9 per cent expected for this year. Looking ahead, however, we can expect cargo markets to be impacted by the Russia-Ukraine conflict. Sanction-related shifts in manufacturing and economic activity, rising oil prices and geopolitical uncertainty are converging. Capacity is expected to come under greater pressure and rates are likely to rise. To what extent, however, it is still too early to predict.”

Russia Ukraine Conflict

The Russia Ukraine conflict will have a negative impact on air cargo. Airspace closures will stop direct connectivity to many markets connected to Russia. Overall, the impact on global markets is expected to be low as cargo carried to/from/within Russia accounted for just 0.6 per cent of the global cargo carried by air in 2021. Several specialised cargo carriers are registered in Russia and Ukraine, particularly those involved with heavy lift operations.

TAKE A READ:

January Regional Performance

- Asia-Pacific airlines saw their air cargo volumes increase 4.9 per cent in January 2022 compared to the same month in 2021. This was significantly below the previous month’s 12.0 per cent expansion. Available capacity in the region was up 11.4 per cent compared to January 2021, however it remains heavily constrained compared to pre-COVID-19 levels, down 15.4 per cent compared to 2019. The zero-COVID policy in mainland China and Hong Kong is impacting performance. Preparations for the Lunar New Year holiday may have also had an impact on volumes, but it is difficult to isolate

- North American carriers posted a 1.2 per cent decrease in cargo volumes in January 2022 compared to January 2021. This was significantly below December’s performance (7.7 per cent). Supply chain congestion due to labor shortages, severe winter weather and issues with the deployment of 5G, as well as a rise in inflation and weaker economic conditions affected growth. Capacity was up 8.7 per cent compared to January 2021

- European carriers saw a 7.0 per cent increase in cargo volumes in January 2022 compared to the same month in 2021. While this was slower than the previous month (10.6 per cent), Europe was more resilient than most other regions. European carriers benefited from robust economic activity and an easing in capacity. Capacity was up 18.8 per cent in January 2022 compared to January 2021, and down 8.1 per cent compared to pre-crisis levels (2019)

- Middle Eastern carriers experienced a 4.6 per cent decrease in cargo volumes in January 2022. This was the weakest performance of all regions and a drop in performance compared to the previous month (2.2 per cent). This was due to a deterioration in traffic on several key routes such as Middle East-Asia, and Middle East-North America. Capacity was up 6.2 per cent compared to January 2021 but remains constrained compared to pre-COVID-19 levels, down 11.8 per cent compared to the same month in 2019

- Latin American carriers reported an increase of 11.9 per cent in cargo volumes in January 2022 compared to the 2021 period. This was a decline from the previous month’s performance (19.4 per cent). Capacity in January was down 12.9 per cent compared to the same month in 2021 and remains well below compared to pre-COVID-19 levels, down 28.9 per cent versus 2019.

- African airlines’ saw cargo volumes increase by 12.4 per cent in January 2022 compared to January 2021. The region was the strongest performer. Capacity was 13.0 per cent above January 2021 levels.

Related topics

Air freight and cargo, Airside operations, Capacity, Cargo, COVID-19, Economy, Winter operations