Insight from American Border stores reveals exciting channel potential

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 1 June 2017 | International Airport Review | No comments yet

An exploration of the retail potential at US border stores…

With the continuing success of border stores in recent years, when other travel retail channel sales have faltered, the potential for developing this channel further are examined in a recently released report.

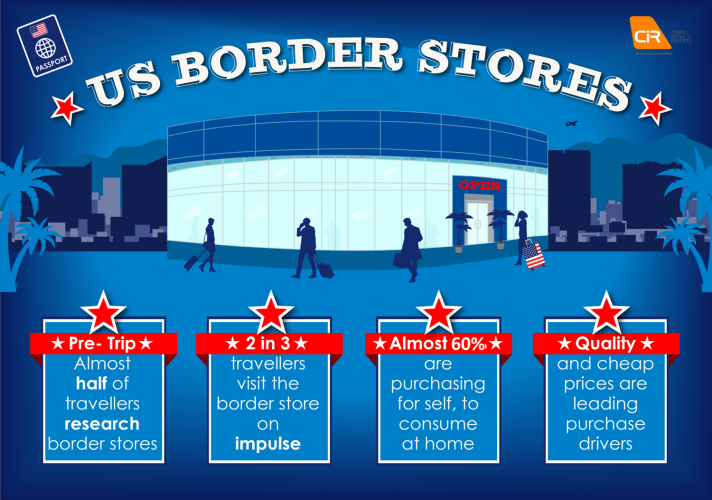

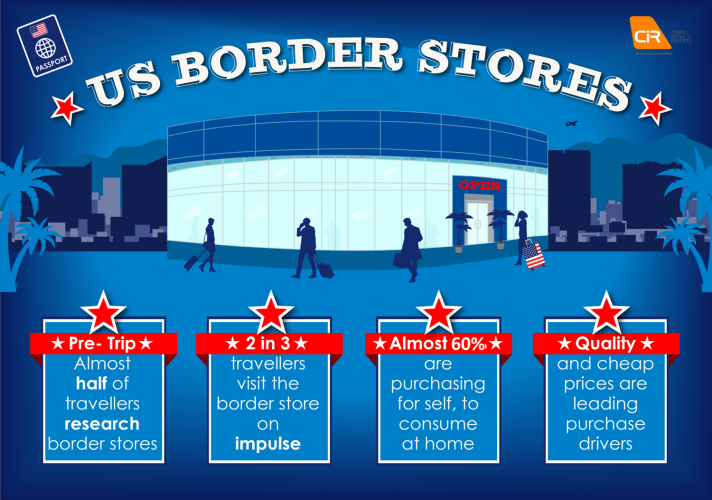

Exclusive research from travel retail analyst, research and category expert, Counter Intelligence Retail, highlights key areas of opportunity for the border stores channel to explore and grow their potential. In a recently completed in-depth research study amongst American, Mexican and Canadian travellers transiting the key border crossing of USA:Mexico and USA:Canada, CiR highlighted key areas for growth with high levels of travel frequency, coupled with high purchasing levels at Duty Free border stores.

The outbound travel market for U.S. residents to Canada and Mexico has continued to grow in this decade, and Mexico is recorded as the top international destination, with Canada in second place, for U.S. residents. Likewise mutual travel from those countries is also strong. Combined with increased border crossings is the strength of the U.S. shopper, having the third largest share of global tax free shopping in 2016, behind China and Russia according to Global Blue.

Source: CIR

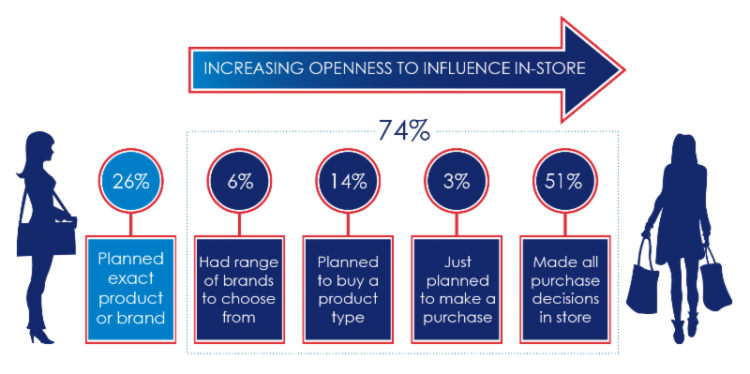

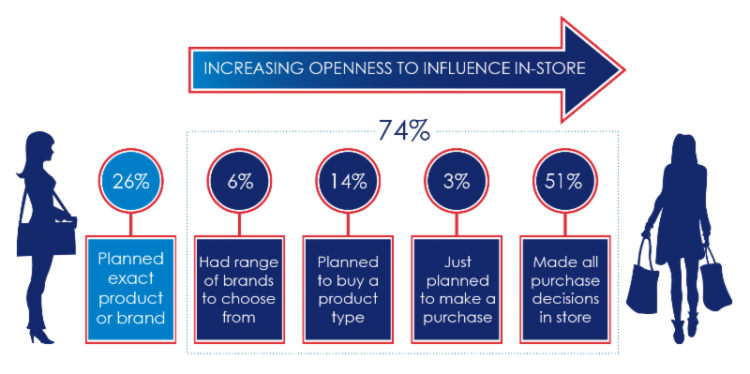

The U.S. border stores have strong conversion rates, with 85% of visitors to store going on to make a purchase. Rates that airport stores aspire to. Store visitors are also open to influence, just 26% have planned their product and brand prior to entering the store. Three quarters of shoppers can be influenced by the store – which is where the opportunities lie.

Opportunities for U.S. Border stores

CiR share three of the opportunities identified in the recent research.

Commenting on the output, Garry Stasiulevicuis, President, Counter Intelligence Retail, says:

“We’ve always known that border stores attract different shopping missions, and shoppers behave differently in this channel. Retailers and brands have fantastic opportunity in this channel, with shoppers more open to influence than we see elsewhere in the tax free environment. Almost half of travellers are researching the stores prior to travel, and the advancing digital market opens up new opportunities to connect with shoppers prior to them leaving their homes”.

1. Increase visit planning

With high impulse visits, the opportunity to increase visit planning amongst all travellers offers increased potential to convert travellers to shoppers, and maximise a spending opportunity. However levels of pre-trip research is high, so the opportunity to highlight awareness to travellers through digital and non-digital sources is evident. Sources include accommodation booking sites, social media and brand websites.

2. Promote brand familiarity

Shoppers in American border stores are drawn to well-known brands, and therefore there is a clear role for leading brands to be given a lighthouse role to draw category shoppers. One quarter of shoppers say that buying a well-known brand is a key purchase driver, and almost two-thirds go on to purchase a regular brand.

3. Improve staff impact

Having a proficient staff presence can influence purchase decision within the store. By increasing levels of interaction through fulfilling enquiries to making positive recommendations, staff have the opportunity to positively enhance the shopping experience for buyers and increase basket spend. Four in ten shoppers reported an interaction with staff, with pricing information being the key driver, but information on product range was also key.

Source: CIR

Available now, this report offers significant potential for retailers and brands, priced at £5,000 (GBP).